Talking Points:

- British Pound may rise if UK CPI tops forecasts, boosts BOE rate hike bets

- Comments from Fed’s Mester unlikely to inspire shift in FOMC policy view

- Australian Dollar, Yen cautiously higher in otherwise quiet AsiaPac trade

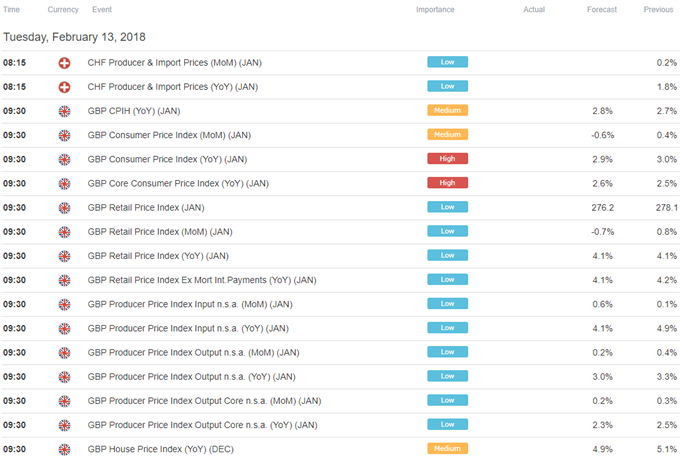

UK CPI data headlines the economic calendar in European trading hours. The headline inflation rate is expected to tick down to 2.9 percent in January, marking the second consecutive decline. The core reading stripping away volatile food and energy prices is seen rising to 2.6 from 2.5 percent however, hinting that a print in line with expectations may not necessarily counter the BOE’s hawkish posture.

Furthermore, UK price growth has data has tended to surprise on the upside relative to consensus forecasts recently. This hints that analysts may be underestimating inflationary pressure and opens the door for more of the same. Such a result may boost the British Pound as investors reprice baseline policy bets for a sooner interest rate hike. As it stands, a better-than-even chance of an increase is priced in as soon as May.

Later in the day, the spotlight turns to a scheduled speech from Cleveland Fed President Loretta Mester. Her broadly hawkish disposition is well-established at this point however, so more of the same seems unlikely to inspire a meaningful reaction. Rather, speculation about the path of FOMC monetary policy is likely to wait for Wednesday’s release of US CPI data as the next major inflection point.

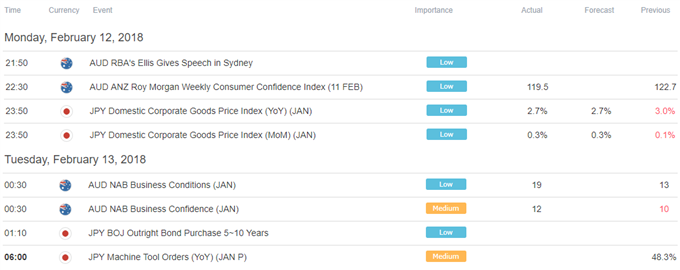

Currency markets marked time in Asia Pacific trade, with most major currencies drifting sideways. The Australian Dollar narrowly outperformed, buoyed by NAB business confidence data showing sentiment hit the most optimistic level in nine months in January. The Japanese Yen also edged up as S&P 500 futures turned lower, hinting at another bout of risk-off selling possibly brewing ahead.

See our guide to learn how to use economic news in your FX trading strategy !

Asia Pacific Trading Session

European Trading Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

To receive Ilya's analysis directly via email, please SIGN UP HERE