Talking Points:

- Euro looks to speech from ECB President Draghi for direction guidance

- Upbeat service-sector ISM survey has may offer a lift to the US Dollar

- Anti-risk Yen gains as Asia Pacific stocks follow Wall Street downward

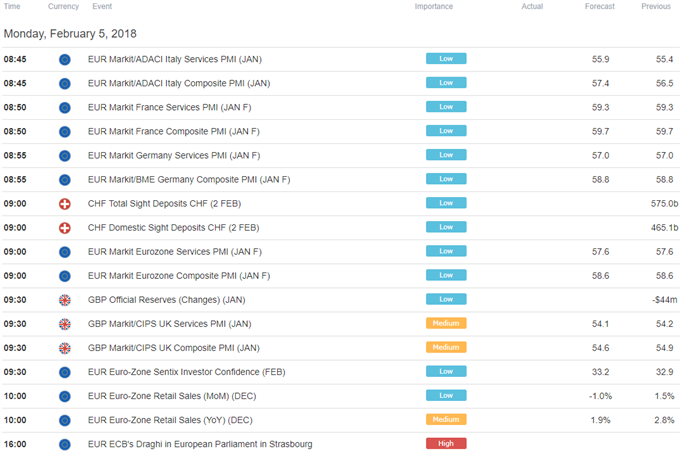

A speech form ECB President Mario Draghi headlines the European calendar. He is due to present an annual report to the European Parliament in Strasbourg. Traders will be keen to see if his remarks hint at a sooner end to QE asset purchases than currently expected. If so, the Euro is likely to rise. A dovish tone may weigh on the single currency however.

Later in the day, the US non-manufacturing ISM survey enters the spotlight. The pace of service sector activity growth is expected to have accelerated in January after hitting a four-month low in the prior month. If the markets’ response to Friday’s rosy US jobs report is indicative, the US Dollar might be rediscovering its sensitivity to fundamental data flow, in which case an upbeat ISM print may send it higher.

The Japanese Yen outperformed in otherwise quiet Asia Pacific trade. The standby anti-risk currency rose as regional shares moved sharply lower, echoing Friday’s dismal performance on Wall Street. The MSCI APAC equity benchmark shed 1.8 percent and Japan’s own Nikkei 225 index lost as much as 2.6 percent. FTSE 100 and S&P 500 futures are pointing firmly lower, hinting at more of the same ahead.

Check out our free guide to see DailyFX analysts’ top trading ideas for 2018 !

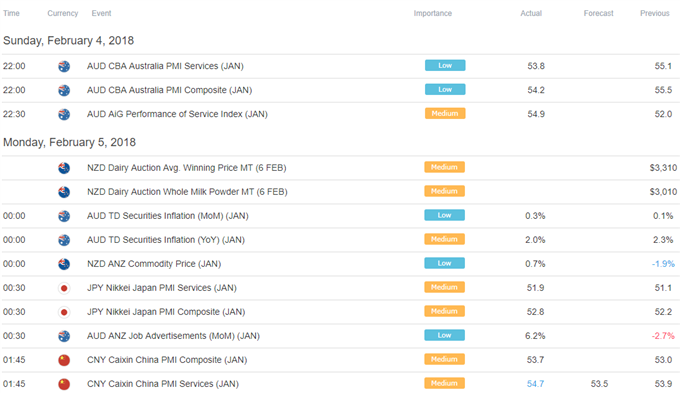

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak