Talking Points:

- US Dollar down after Trump’s SOTU speech, FOMC may offer a lifeline

- Aussie Dollar down on CPI miss, NZ Dollar higher as US yields decline

- Eurozone inflation drop might not translate into lasting Euro weakness

The US Dollar slumped in disappointment following President Donald Trump’s first State of the Union address. The speech offered nothing particularly novel, dashing speculation that the President would unveil specifics about the next stage of an aggressively expansionary fiscal program, ushering in an inflationary surge that forces the Fed into a steeper rate hike cycle.

Ebbing Fed tightening speculation translated into gains for currencies competing for yield appeal with the greenback. Not surprisingly, that led the New Zealand Dollar upward, with the currency tellingly rising inversely of a drop in US Treasury bond yields. The Australian Dollar failed to capitalize however having been humbled by CPI data that fell short of consensus forecasts.

Eurozone CPI data headlines the data docket in European trading hours. The headline year-on-year inflation rate is expected to tick down to 1.2 percent in January, the lowest in over a year. A soft result on analogous German price growth data yesterday produced a brief Euro downswing but failed to find follow-through. Absent a wild deviation from forecasts, more of the same is probably in store.

The spotlight then turns to the FOMC rate decision, which may be a non-event this time. Officials might be less concerned with shaping policy guidance than managing a smooth transition from Janet Yellen – for whom this will be the last outing as Chair – to incoming Jerome Powell. Still, a recent upshift in market measures of inflation expectations might bring a slightly hawkish tone, offering a lifeline to the greenback.

Check out our free guide to see DailyFX analysts’ top trading ideas for 2018 !

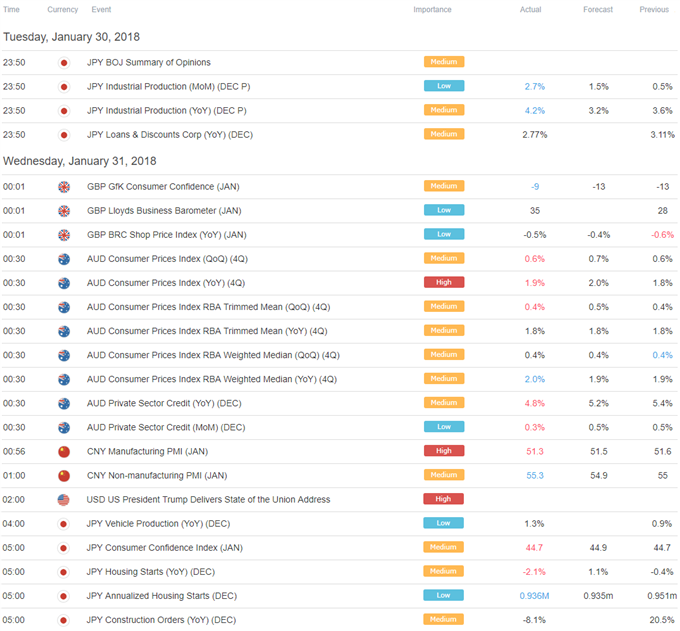

Asia Session

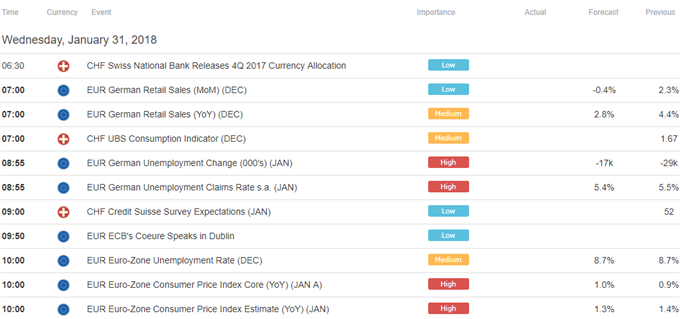

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak