Talking Points:

- US Dollar may rise if Powell hints three Fed hikes still make sense in 2018

- Kiwi Dollar still rising before key testimony from RBNZ Governor Spencer

- Japanese Yen corrected lower despite risk-off mood in Asia Pacific trade

The European data docket offers relatively little to excite volatility. The OECD will release an updated set of economic projections but absent a dramatic bombshell, this seems unlikely to inspire lasting follow-through from asset prices.

Comments from Fed Governor Jerome Powell may dominate the spotlight as he testifies in a confirmation hearing after being nominated to take over at the helm of the US central bank in February, when Janet Yellen’s term expires. If he suggests September’s FOMC projections calling for three rate hikes next year still seem appropriate, the US Dollar may trade higher.

The New Zealand Dollar continued to push higher in Asia Pacific trade, mirroring yesterday’s outperformance. As with the preceding session, a singular catalyst for the move is not apparent. Short-covering ahead of parliamentary testimony from RBNZ Governor Grant Spencer – pivotal at a time when the government is mulling a change in the central bank’s remit – may account for the advance.

Meanwhile, the Japanese Yen retraced lower having outperformed against nearly all of its major counterparts in the preceding 24 hours (with the Kiwi being the sole exception). The case for calling the move corrective seems all the more compelling considering stocks fell across regional bourses, offering up the kind of environment that would typically boost the perennially anti-risk currency.

Need help incorporating economic news into your trading strategy? Check out our guide !

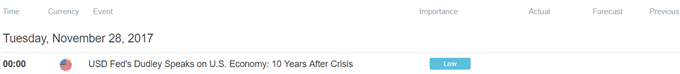

Asia Session

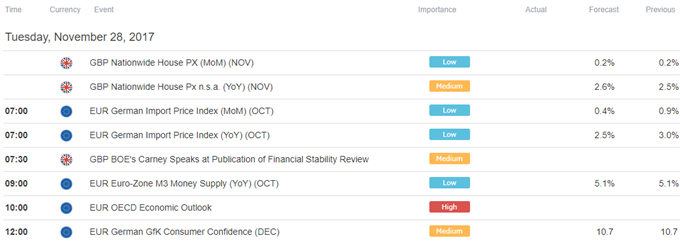

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak