Talking Points:

- US Dollar mounts recovery following geopolitically-driven selloff

- Prospects for passing US tax cut legislation to inform Fed outlook

- Japanese Yen broadly lower as stocks rise in Asia Pacific session

The US Dollar corrected broadly higher in Asia Pacific trade following yesterday’s selloff, a move seemingly driven by the knock-on effects of geopolitical jitters on 2018 Fed interest rate hike prospects. The Australian and New Zealand Dollars suffered outsized losses, tellingly reversing yesterday’s trade dynamics. The perennially anti-risk Japanese Yen declined as stocks pushed higher across regional exchanges.

Scheduled commentary from ECB President Mario Draghi from the central bank’s forum on banking supervision is a standout on an otherwise lackluster European calendar. The remarks may not prove meaningfully market moving for the Euro however in that they will probably mean little for near-term policy bets after the path of QE asset purchases was established two week ago.

The US data docket is no more exciting, with a small handful of releases and a speech from supervision Vice Chair Randal Quarles on tap. None of this is likely to be more formative for Fed rate hike bets – and thereby USD – as the prospects for inflationary tax cuts. Indeed, speculation on their passage looks likely to be the defining catalyst for the greenback this week.

The Senate is due to present its version of tax reform this week, with the timing understandably unclear thus far. Tuesday will see top White House aides heading to Capitol Hill in an attempt to sell Democrats on backing a version of the plan as several GOP lawmakers break party lines to oppose the version produced in the House of Representatives. Traders will monitor headlines emerging from the meeting with interest.

What is the #1 mistake that FX traders make, and how can you fix it? Find out here !

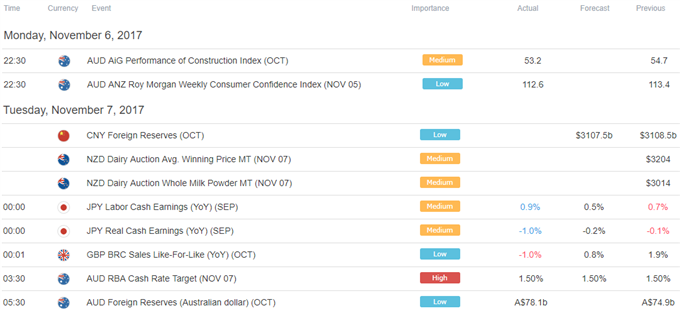

Asia Session

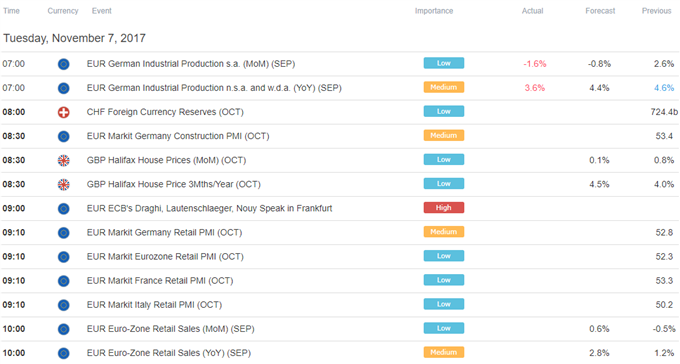

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak