Talking Points:

- Euro bias favors weakness as ECB unveils QE program upgrade

- US Dollar down with Treasury yields as Fed rate hike bets cool

- Yen up as Nikkei backtracks after upside gap, NZ Dollar lower

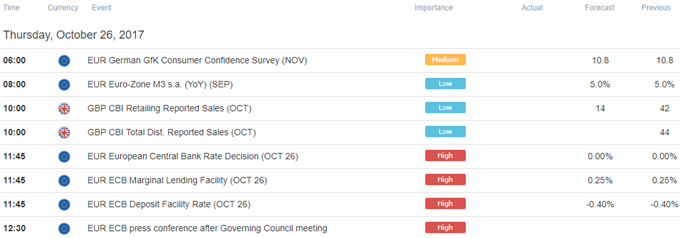

All eyes are on the ECB monetary policy announcement in European hours. President Mario Draghi and company are widely expected to “taper” the size of monthly QE asset purchases while extending the program beyond 2017. Baseline expectations envision halving the current pace of uptake from €60 to €30 billion and pushing the expiration date out by nine months.

The Governing Council has surely considered that Euro gains in 2017 will likely act as a disinflationary force in next year’s CPI data. With that in mind, policymakers may be especially careful not to deliver an outcome that drives the single currency upward and thereby undermines the effort to bring inflation back to the ECB target of just below 2 percent.

A smaller cutback in purchases – perhaps to €40 billion/month – may be way to achieve this. The hawkish contingent on the Council could be mollified by a shorter 6-month extension, paving the way for a relatively sooner rethink should further tapering be appropriate. In any case, Mr Draghi is likely to use the post-meeting press conference to downplay any hawkish exuberance by the announcement might trigger.

On balance, the defining assessment of whatever policy combination is unveiled will most probably depend on the total size of additional stimulus on offer. Consensus forecasts translate into €270 billion additional QE. A larger overall boost will probably send the Euro lower while a smaller one inspires gains. The upside may be limited however considering all available scenarios amount to more easing, not less.

The US Dollar edged broadly lower in Asia Pacific trade. The currency declined alongside front-end Treasury bond yields, hinting at a pullback in Fed rate hike bets as the driver behind the move. The perennially anti-risk Yen rose as Japan’s Nikkei 225 stock index pulled back after gapping higher at Tokyo session open. Political uncertainty jitters continued to weigh on the New Zealand Dollar.

Have a question about trading in the FX markets? Join a Q&A webinar and ask it live!

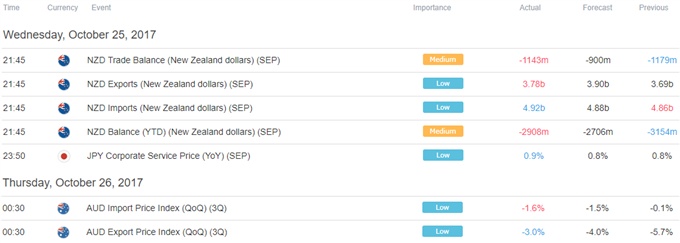

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak