Talking Points:

- British Pound may rise on BOE credit, bank lending surveys

- US Dollar looking to firming wholesale inflation for a lifeline

- Political uncertainty fading as a headwind for the NZ Dollar

The US Dollar fell against its G10 FX peers in Asia Pacific trade as regional markets took their turn to price in the release of minutes from September’s FOMC meeting. The document revealed that many Fed officials are concerned that low inflation is not temporary, pouring a bit of cold water on rate hike speculation.

The yields-sensitive Australian and New Zealand Dollars duly outperformed. Tellingly, the two currencies marched higher in near-perfect lockstep with 2-year US Treasury bond futures, implying a drop in front-end borrowing costs consistent with a dovish shift along the expected Fed policy spectrum.

The Kiwi’s ability to capitalize hints that headwinds from political uncertainty after an inconclusive general election may be ebbing. Kingmaker and NZ First party leader Winston Peters delayed a decision on whether he will support ruling National or opposition Labour to form the next government until next week.

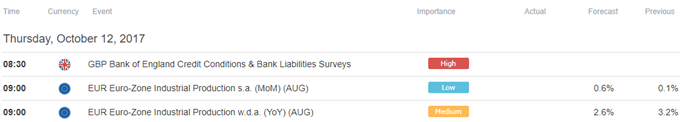

From here, the Bank of England Credit Conditions and Bank Liabilities surveys are in focus. Data from Bloomberg shows the funding landscape has loosened since mid-August. Confirming as much may be seen as lowering the barrier for BOE rate hikes, sending the British Pound upward.

Later in the day, September’s US PPI data comes into the spotlight. An outcome echoing steadily improving US news-flow since mid-June arrest the greenback’s losses but lasting progress seems unlikely until the more potent CPI inflation gauge crosses the wires on Friday.

Want to incorporate major economic news events into your trading strategy? See our guide here !

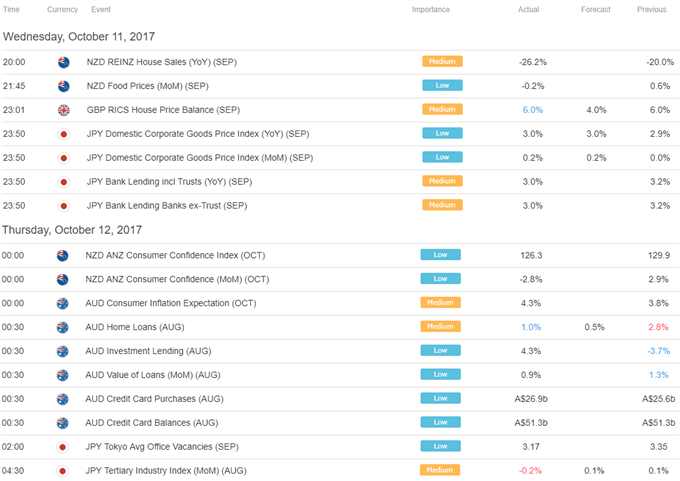

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak