Talking Points:

- Quiet European data docket puts Fed rate decision in the spotlight

- The start of “quantitative tightening” an all-but-forgone conclusion

- US Dollar outlook hinges on rate hike path forecast through 2019

A lackluster offering on the European economic data docket puts the Fed monetary policy announcement firmly in the spotlight. The FOMC committee is expected to unveil its plan for so-called “quantitative tightening” (QT) – a program to unwind its swollen post-crisis balance sheet – as well as offer an update of official rate hike path projections.

Chair Janet Yellen and company have extensively talked up the onset of QT in recent months, making its emergence all but certainly priced in. Fed officials have also stressed that they want the pace of asset runoff to be so gentle as to make the process go nearly unnoticed, meaning that traders are unlikely to be especially disappointed even if the first foray seems unduly timid.

This means it is the revised rate hike forecast that has the most potential to drive volatility. Traders price in a close to even chance of a third increase this year (52.5 percent), leaving ample room to adjust in the hawkish or dovish direction. 2018 and 2019 projections may also be important in that they will reveal if softer inflation in the first half of this year have made for shallower long-term path.

On balance, a call for one more hike in 2017 and a slight downward revision of 2018 and 2019 tightening prospects seem to be status quo. A supportive scenario for the US Dollar would see the latter readings left unchanged, with an upgrade likely to offer a more sizable lift. Dropping the call for another increase this year and lowering long-term expectations seems like the most dovish, USD-negative alternative.

The New Zealand Dollar was most active in otherwise quiet Asia Pacific trade. The unit spent most of the session on the defensive as prices corrected following yesterday’s broad outperformance. The Kiwi came roaring back higher later in the day however after a poll showed the incumbent National party widening its lead on rival Labour ahead of a general election on September 23.

Have a question about trading in the FX markets? Join a Q&A webinar and ask it live!

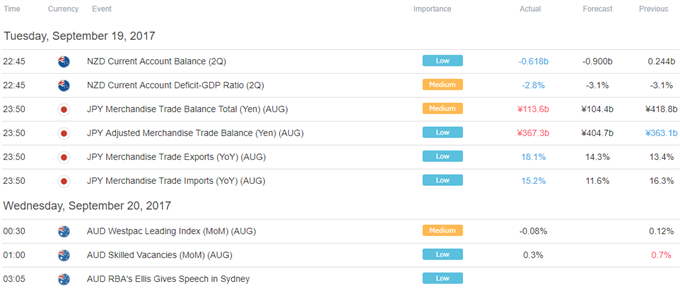

Asia Session

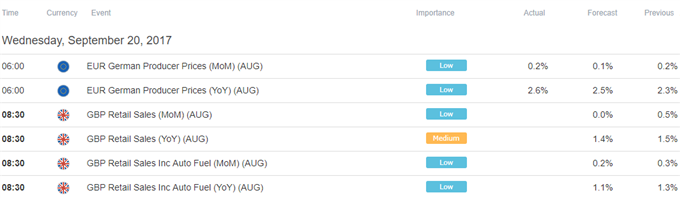

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak