Talking Points:

- North Korea nuclear weapon test triggers market-wide risk aversion

- Yen and Franc higher, Aussie and Canadian Dollars under pressure

- Euro gains before ECB rate decision, NZ Dollar in correction mode

The anti-risk Japanese Yen and Swiss Franc traded higher while the sentiment-linked Australian and Canadian Dollars declined after North Korea tested a nuclear weapon over the weekend, souring investors’ mood at the start of the week. The New Zealand Dollar held up a bit better than its commodity bloc brethren, benefitting from corrective flows following last week’s slump against the G10 FX spectrum.

The Euro likewise found a bit of upward traction. The move may reflect pre-positioning ahead of this week’s ECB monetary policy announcement, which some speculate will lay the foundation for incrementally phasing out – or “tapering” – its QE asset purchase effort. Central bank officials have pushed back somewhat against a hawkish narrative, so lasting follow-through may be too much to ask for in the near term.

Looking ahead, North American financial markets will be mostly offline for Labor Day. Not surprisingly, that translates into the absence of noteworthy event risk, meaning existing momentum will face relatively few roadblocks to continuation. News-flow from the Korean peninsula remains an obvious wild card however, with thin liquidity conditions a possible amplifying factor for any knee-jerk volatility.

Just getting started trading in the FX markets? Check out our beginners’ guide !

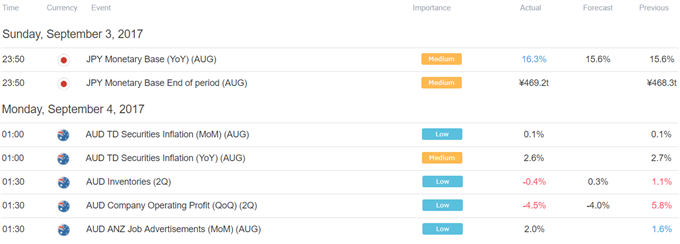

Asia Session

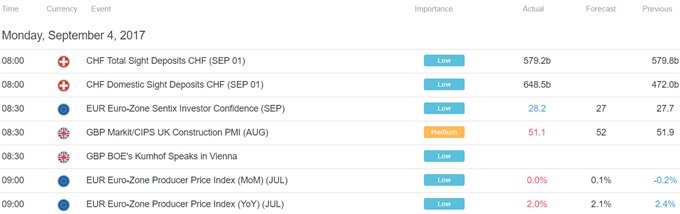

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak