Talking Points:

- US Dollar oscillating in familiar territory as Yellen speech looms

- Euro may shrug off ZEW survey data as markets wait for Draghi

- Japanese Yen may continue to decline amid risk appetite recovery

The US Dollar edged higher in a move that seemed corrective following the decline in the prior session. In broader terms, the greenback continues to occupy the same broad range that has confined price action over the past week against its major counterparts. Substantive follow-through may have to wait for a clearer lead on the direction of Fed policy, which investors will look for in a speech from Janet Yellen this week.

The Japanese Yen traded lower as most stocks rose across Asia Pacific bourses, tarnishing the appeal of the standby anti-risk currency. European FX majors also declined, with the British Pound bearing the brunt of selling pressure. That may reflect renewed Brexit-related jitters as the UK government prepares to publish its third position paper the future EU/UK relationship in two days, this time focusing on judicial matters.

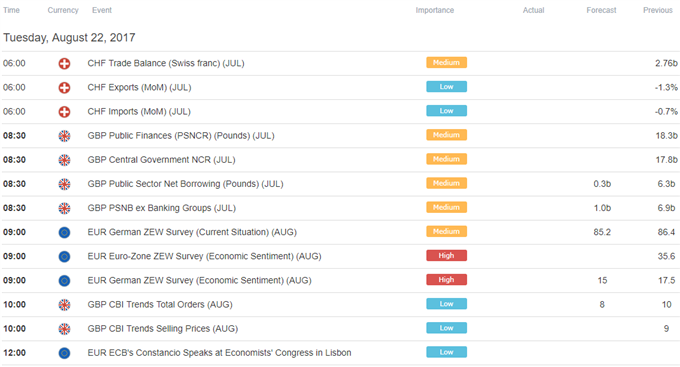

The European economic data docket is relatively tame. The German ZEW survey of analysts’ sentiment take stop billing but the outcome seems unlikely to find follow-through from the Euro regardless of what comes across the wires as markets wait for a much-anticipated speech from ECB President Mario Draghi at the Fed conference in Jackson Hole, Wyoming on Friday.

The day’s offering of US releases is sparser still, which may put sentiment trends back into the spotlight. Futures tracking the benchmark S&P 500 stock index are pointing higher ahead of the opening bell on Wall Street, hinting at a risk-on mood that may most clearly speak to further Yen weakness. Political volatility in the US may yet change things however as President Trump holds a rally in Arizona.

Just getting started trading in the FX markets? Check out our beginner’s guide !

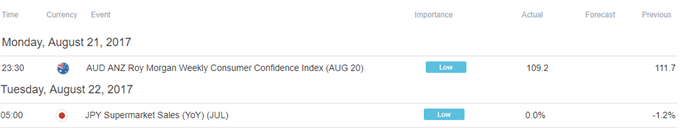

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak