Talking Points:

- Euro, British Pound may fall on as Q2 GDP and PMI figures disappoint

- US Dollar may find a lifeline if PCE, ISM figures outperform expectations

- Are FX markets matching DailyFX forecasts so far in Q3? Find out here

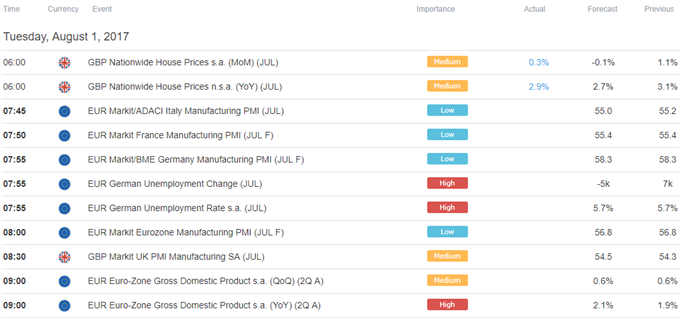

Investors will get their first look at second-quarter Eurozone GDP figures in European trading hours. The report is expected to show an increase of 0.6 percent, matching the gain in the three months through March. The on-year growth rate is seen rising to 2.1 percent however, the highest in over six years.

Recent stabilization notwithstanding, economic news-flow out of the currency bloc has soured relative to consensus forecasts since the beginning of July (according to statistics from Citigroup). This opens the door for a disappointment that cools near-term ECB policy normalization bets, hurting the Euro.

Meanwhile, July’s UK manufacturing PMI data is expected to deliver a pickup in sector growth after a slump to three-month lows in June. Here too, a series of increasingly soft results in recent months may foreshadow a weaker print that undermines tightening bets. That might sting the British Pound.

Later in the day, the spotlight turns to US PCE and ISM figures. The former is projected to show that the Fed’s favored core inflation gauge remained unchanged at 1.4 percent year-on-year in June. The latter is forecast to reveal a slowdown in the pace of factory-sector activity growth.

Unlike the Euro area, the US has managed to put up economic data that has increasingly improved relative to expectations since mid-June. Results echoing these outcomes may see investors upgrade the probability of another Fed rate hike in 2017, boosting the US Dollar.

Have a question about trading the FX markets? Join a Q&A webinar and ask it live!

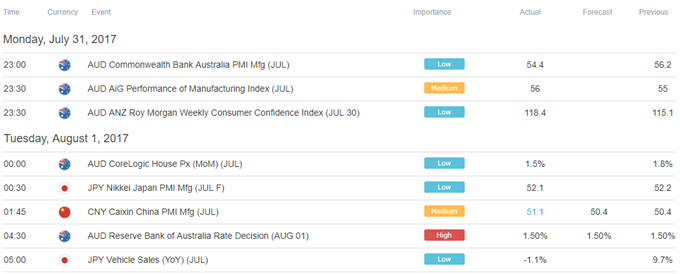

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak