Talking Points:

- Yen falls, Aussie and NZ Dollars rise markets’ mood improves in Asia

- US employment now in focus, with leading surveys looking optimistic

- Firm payrolls data may boost post-June Fed rate hike bets, US Dollar

The anti-risk Japanese Yen fell while the sentiment-sensitive Australian and New Zealand Dollars traded higher alongside stocks in Asian trade. The MSCI Asia Pacificregional equity benchmark added nearly a full percentage point, echoing a surge on Wall Street triggered by a round of supportive US economic data.

From here, a lackluster offering on the European data docket puts the spotlight on the always much-anticipated monthly set of US labor market statistics. The economy is expected to have added 182k jobs last month, a slight slowdown from a 211k gain in March. The jobless is seen holding at 4.4 percent.

Leading survey data hints that a more optimistic outcome may be in store. Most interestingly, the pace of job creation in the service sector – the largest US employer by a long mile – appears to have accelerated in May after hitting a near-seven year low in the prior month.

If this proves telling, a strong outcome may revive speculation about continued Fed rate hikes to follow after this month’s all-but-certain 25 basis point increase. Needless to say, that would bode well for the US Dollar. At this stage, investors see a 50/50 chance of a third increase by year-end.

Retail traders are betting on US Dollar strength. Find out here what this hints about the price trend!

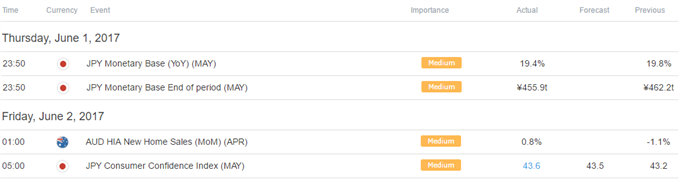

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak