Talking Points:

- US Dollar may drop as ADP, ISM outcomes disappoint

- Australian Dollar down after soft Chinese PMI statistics

- British Pound corrects lower after poll-driven volatility

A relatively lackluster offering on the European data docket is likely to see investors focused on US news-flow. The ADP estimate of US jobs growth and the ISM survey of manufacturing – both for the month of May – are set to come across the wires.

The former is predicted to show a180k increase in payrolls, a slight improvement from April’s figures. The latter is expected to reveal that the pace of factory-sector activity growth slowed over the same period, marking the third consecutive month of deterioration.

Soft numbers echoing mostly disappointing US economic data outcomes since mid-March may weigh on Fed rate hike expectations, denting confidence in the Fed’s ability to continue raising rates beyond this month’s widely expected increase. That has scope to weigh on the US Dollar.

The Australian Dollar underperformed in Asian trade, stung by disappointing manufacturing PMI data out of China. The British Pound corrected lower having scored the largest gain in four weeks against its major counterparts in the prior session.

Sterling rose inversely of a drop in UK government bonds after polls from Panelbase and Kantar showed support for the ruling Conservative party rebounding before next week’s general election. The rally stalled after another set of polls, this time from SurveyMonkey and YouGov, painted the opposite picture.

Need help turning your market opinions into a strategy? See our trading guide !

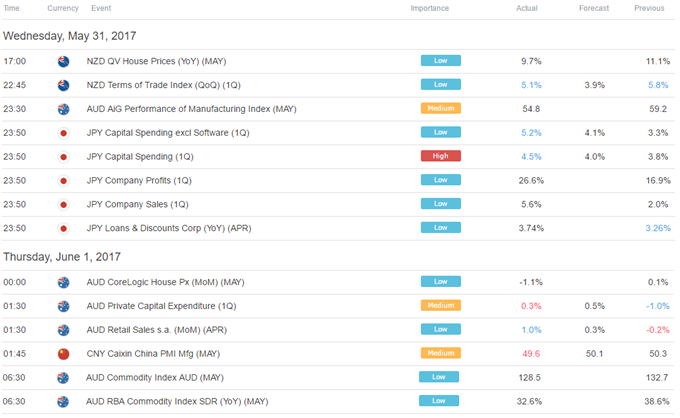

Asia Session

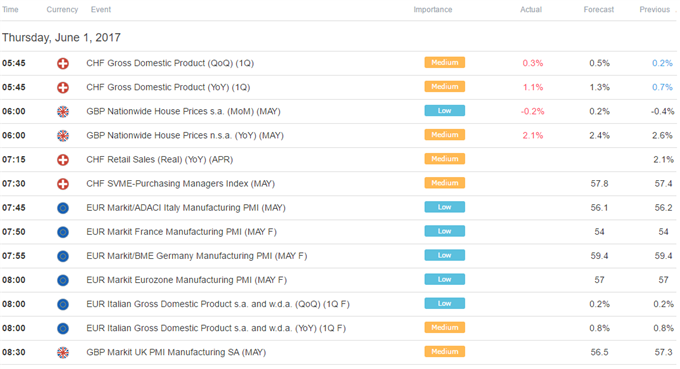

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak