Talking Points:

- Yen may extend gains as G7 rancor weighs on risk appetite

- US Dollar may drop as revised Q1 GDP data disappoints

- British Pound falls as Tories’ lead shrinks before election

The Yen outperformed in Asian trade as most regional stock exchanges suffered, boosting the perennially anti-risk Japanese currency. Energy and raw materials shares plunged in a move that probably echoed yesterday’s dramatic drop in crude oil prices. That seemed to reflect profit-taking after the extension of an OPEC-led output cut scheme offered nothing that was not already priced in.

The British Pound fell after a YouGov poll – the first since the terrorist attack in Manchester – showed ebbing support for the ruling Conservative party. The Tories’ lead shrank to 5 percent, the smallest since mid-July 2016 when Prime Minister Theresa May just took the reins after the Brexit referendum. The specter of uncertainty a mere two weeks before an election sent capital fleeing from GBP-denominated assets.

The absence of top-tier European economic data will put the spotlight on a meeting of G7 leaders in Taormina, Sicily. Disagreement about international trade norms is likely to be of greatest interest to investors. US President Trump is a vocal free trade skeptic, putting him at odds with his counterparts. Signs of growing tension may dent risk appetite, compounding Yen gains.

A revised set of first-quarter US GDP figures then comes in focus. The annualized growth rate is expected to be upgraded to 0.9 percent from the initially reported 0.7 percent. A steady string of disappointing US news-flow over the past two months opens the door for a disappointment that may cool Fed rate hike speculation, weighing on the US Dollar.

What are the DailyFX team’s favorite trade ideas for 2017? Find out here !

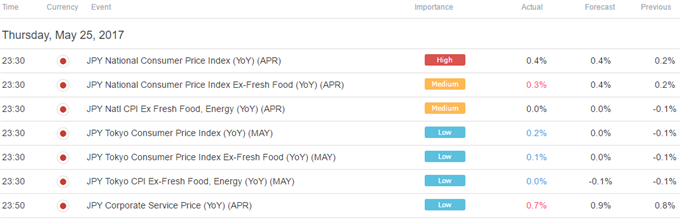

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak