Talking Points:

- FX markets mark time in Asia after brutal risk aversion

- NZ Dollar down as yields, demand wilt at bond auction

- News-flow from Washington DC firmly in the spotlight

The New Zealand Dollar underperformed in otherwise quiet Asian trade. The currency fell alongside local bond yields, pointing to a shift in the dovish direction along the expected monetary policy spectrum as the catalyst behind the selloff.

The results of a bond auction may have set the stage for the move. An offering of paper maturing in 2025 fetched an average yield of 2.695 percent, down from 2.889 percent on analogous paper sold a month ago. The bid-to-cover ratio ticked down from 3.4 from 4.5 previously, pointing to ebbing demand.

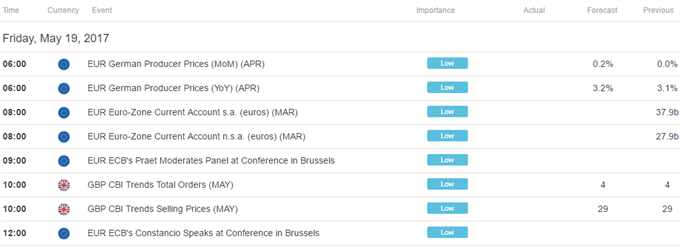

From here, a dull offering of European economic data and an altogether empty US docket is likely to keep broad-based sentiment trends in focus. This will probably keep investors looking to news-flow out of Washington DC for direction cues.

An uneasy calm has settled over financial markets after fears about political instability in the US roiled prices across the range of asset classes. Headline sensitivity remains elevated to say the least however. Uncertainty surrounds what that may mean for risk appetite into the week-end.

What do retail traders’ US Dollar bets hint about the coming price trend? Find out here !

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak