Talking Points:

- Japanese Yen drops as risk appetite firms to start the trading week

- Canadian Dollar leads commodity bloc FX higher as oil prices rise

- US stock index futures suggest risk-on dynamics likely to continue

The anti-risk Japanese Yen traded sharply lower while the sentiment-linked commodity bloc currencies followed S&P 500 futures upward as risk appetite firmed at the start of the trading week. The Canadian Dollar outperformed, rising alongside crude oil prices after Russia and Saudi Arabia said they favor extending an OPEC-led production cut scheme due to expire mid-year through the first quarter of 2018.

A number of developments helped make for an upbeat mood. The communique following the G7 finance ministers’ meeting tactfully sidestepped thorny issues of international trade, Angela Merkel’s CDU looks to have triumphed in a bellwether state of North Rhine-Westphalia, and China pledged $78 billion in financing for its Belt and Road global trade initiative.

From here, a lackluster offering on the economic data docket is likely to keep risk sentiment trends at the forefront. European bourses look to be in a cautiously optimistic mood and futures tracking top US equity benchmarks are gaining ground ahead of the opening bell on Wall Street. On balance, this points to a risk-on mood that seems likely to see overnight price patterns carry onward, at least in the near term.

Have a question about trading FX markets? Join a Q&A webinar and ask it live!

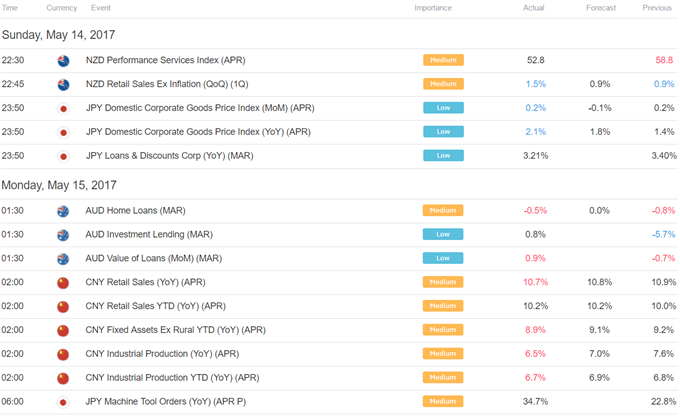

Asia Session

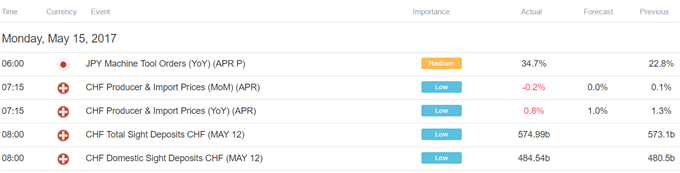

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak