Talking Points:

- Pound falls on rumors government expects another Scottish independence vote

- Aussie Dollar gains on corporate profits data, NZ Dollar falls with local yields

- US Dollar may not find lasting cues in data, Fed-speak as Trump speech looms

The British Pound underperformed in an otherwise quiet start to the trading week, sliding against all of its G10 FX counterparts. According to the newswires, the move was triggered by a story in the Times of London alleging that UK Prime Minister Theresa May is preparing for a another referendum on Scottish independence following Brexit.

The Australian Dollar advanced following impressive corporate profits data for the fourth quarter. The New Zealand Dollar declined alongside local bond yields, pointing to ebbing RBNZ rate hike bets as the catalyst driving selling pressure. The move followed data showing the largest migration gain in at least 35 years, which markets may have read as a cap on wage inflation limiting scope for tightening.

Looking ahead, a quiet European economic calendar might have been expected to put Fed rate hike speculation back into the spotlight as January’s US Durable Goods Orders and Pending Home Sales data is published and comments from Dallas Fed President Kaplan cross the wires. The US Dollar seems unlikely to pay much attention however, waiting for an upcoming speech form President Trump to offer direction cues.

Have a question about trading the financial markets? Join a Q&A webinar and ask it live!

Asia Session

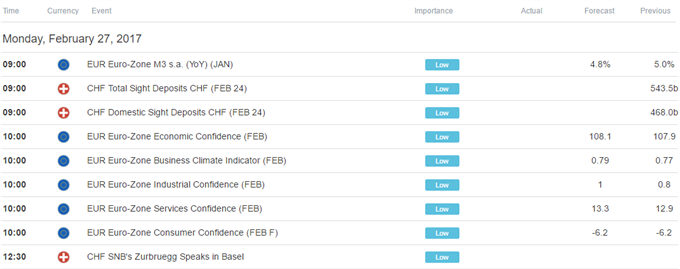

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak