WTI Crude Oil Talking Points

- Crude oil prices put in a strong trend from November to March, jumping by more than 99% from low to high.

- Oil prices broke above a big long-term trendline in March, and shorter-term price action has built into a bull pennant formation.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

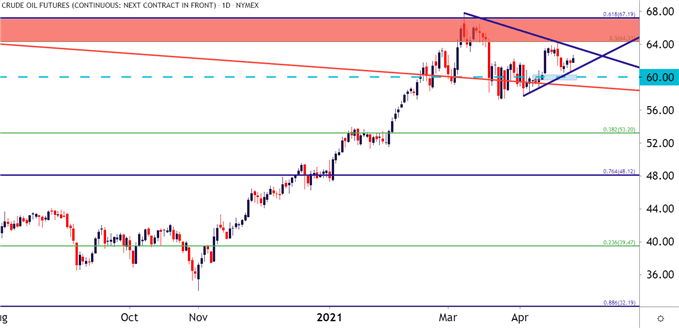

Crude oil prices continue to congest following a big trend that ran from last November into this March. Over this stretch WTI crude oil prices had gained more than 99%, running until a big zone of long-term resistance began to come into play around the $64-67 area on the chart. That resistance stymied bulls and prices quickly pulled back, soon turning into a range before starting to show bearish potential should WTI remain below the psychological 60-handle.

But bulls remained persistent and prices quickly pushed back above that 60 level. There’s also been a build of higher-lows over the past few weeks that, when combined with the lower-highs, produce a symmetrical triangle. That symmetrical triangle showing at the top of a four-month bullish trend that produced as more than 99% makes for a bull pennant formation, often followed with the aim of bullish continuation scenarios.

To learn more about the bull pennant, check out DailyFX Education

WTI Crude Oil Daily Price Chart

Chart prepared by James Stanley; CL2 on Tradingview

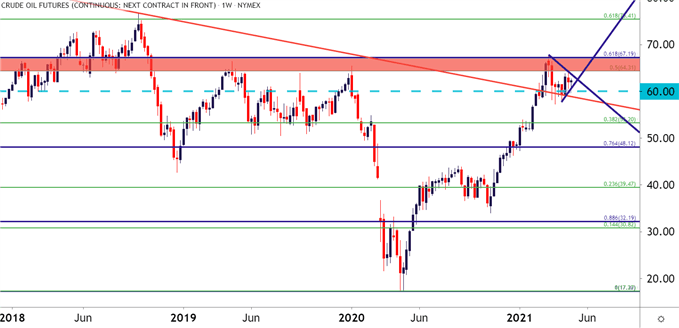

Taking a step back on the weekly chart and a couple of things stand out. That March high was a fresh two year high, and the corresponding pullback, so far, has been rather shallow. But also of interest is another trendline and this one is longer-term in scope. It’s shown on the below chart in red, and this is a bearish trendline projection that for the past seven weeks has been helping to hold higher-low support. This is another bullish factor in the technical backdrop for crude oil prices.

WTI Crude Oil Weekly Price Chart

Chart prepared by James Stanley; CL2 on Tradingview

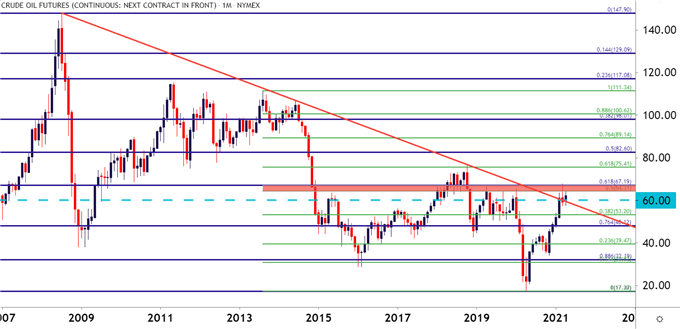

For the final chart, I’m looking at the monthly below and this is to highlight the importance of that longer-term trendline that’s currently helping to form support.

The bearish trendline originates from the 2008 high and connects to the 2014 high. That projection helped to catch the 2018 high in October of that year, as well as the February 2021 high. The month of March saw bulls grind through this level until, eventually, it began to help form short-term support.

A continued hold above that trendline, combined with the bull pennant formation looked at above, can keep the focus on topside scenarios for wti crude oil prices in the coming days, especially considering the risk outlay on the economic calendar for the remainder of this week.

To learn more about proper trendline construction, check out DailyFX Education

WTI Crude Oil Monthly Price Chart

Chart prepared by James Stanley; CL2 on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX