Canadian Dollar, CAD, USD/CAD Price Analysis

- This morning brought a Bank of Canada rate decision, this Friday’s economic calendar brings Canadian jobs numbers to be released at the same time as US Non-Farm Payrolls.

- The bank held rates, and given the change in leadership the big question is forward-looking strategy at the bank.

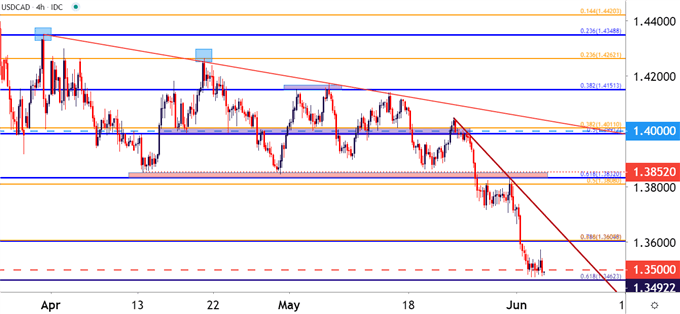

- USD/CAD broke down from a descending triangle formation, and is now finding support around the 1.3500 big figure. But sellers haven’t yet been able to establish any significant trends around that support, leading to the prospect of short-term pullback.

BoC Leaves Rates Flat, USD/CAD Remains Around 1.3500

Earlier this morning we heard from the Bank of Canada as the BoC left rates flat; but the prospect of change in leadership atop the BoC does highlight potential changes in the future after outgoing Bank of Canada Governor Stephen Poloz had previously stated that rates were as low as they could go. Taking over at the bank this week is Tiff Macklem, and as noted by our own Thomas Westwater earlier today, this morning’s statement likely had little input from the newly-installed BoC Governor. This does, however, point to the possibility of change on the horizon given how aggressively the coronavirus slowdown has hit global economies.

In USD/CAD, the pair has largely clung on to support around this rate decision, temporarily testing below the big figure of 1.3500 but, so far, failing to establish any continued bearish trends below that level. And this comes on the heels of an earlier-week breakdown, as USD/CAD had built into a descending triangle formation, with a series of lower-highs from late-March into mid-May, combined with horizontal support around the 1.3850 area on the chart.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

Can USD/CAD Bears Drive Through Psychological Support?

Of recent, commodity currencies have been on a tear against the US Dollar, USD/CAD included. AUD/USD has been on a similar display of recent and the same can be said for NZD/USD.

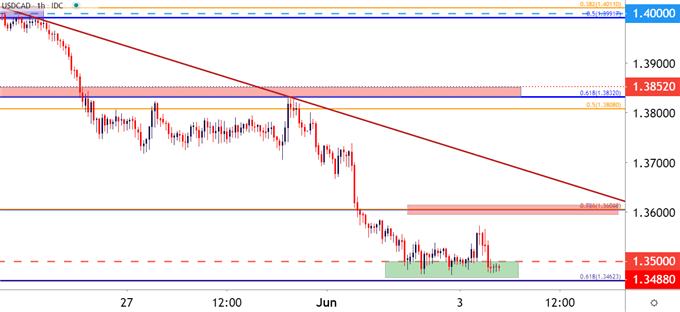

The trouble at this point for USD/CAD bears is the fact that the short-side move is already fairly well-developed; and prices are showing continued support around the 1.3500 big figure. Can USD/CAD bring sellers in at sub-1.3500 prices to continue pushing lower? Or, will the pair need a retracement first before continuing that bearish trend?

| Change in | Longs | Shorts | OI |

| Daily | 6% | -9% | -5% |

| Weekly | 8% | -2% | 1% |

On the chart is a nearby area of interest for resistance potential. As looked at in yesterday’s webinar, the space around the 1.3600 area seems especially interesting, as there are two very recent Fibonacci levels within close proximity of each other. This is the 61.8% retracement of the 2020 major move, and the 78.6% retracement of the March major move. At this point, that zone hasn’t yet been tested for resistance and a show of sellers here could re-open the door for bearish continuation strategies in the pair.

USD/CAD Hourly Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX