US Dollar Talking Points:

- The US Dollar is clawing back last week’s losses, helping along by a strong reversal in GBP/USD along with a resistance inflection in EUR/USD.

- The US Dollar is currently sitting on a gain for 2019 but that was very much in question just a week ago. Will USD-bears stage a return? A key area of resistance sits just ahead on DXY.

Last week saw the US Dollar push down to a fresh five-month-low on Friday, helped along by a sizable breakout in the British Pound as driven by UK election results. But as that move has priced-out of Sterling, with the entirety of the election gains now taken-out, the US Dollar has pushed higher over the past three, now four trading days, to reclaim a portion of that lost ground. The big mover against the US Dollar has, of course, been the British Pound. But a couple of other items of interest are showing elsewhere such as against the Japanese Yen or the Euro. I dug into these themes in yesterday’s webinar, focusing in on what next year might have in the card for the FX space.

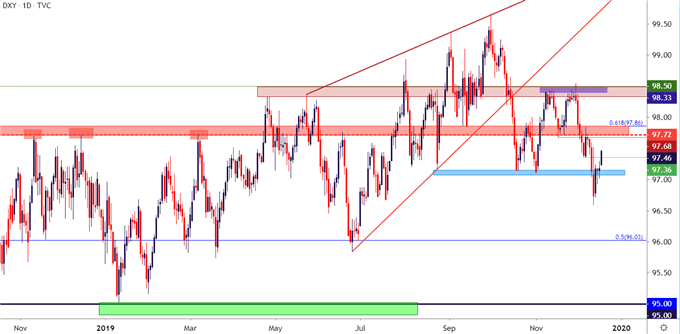

In USD, price action is currently testing above the prior swing low around 97.36, with a big zone of resistance sitting ahead around the 97.70 marker that’s come back into play over the past couple of months. That was the same price that held the yearly high last November and December, coming back into play in March of this year.

US Dollar Daily Price Chart

Chart prepared by James Stanley; US Dollar on Tradingview

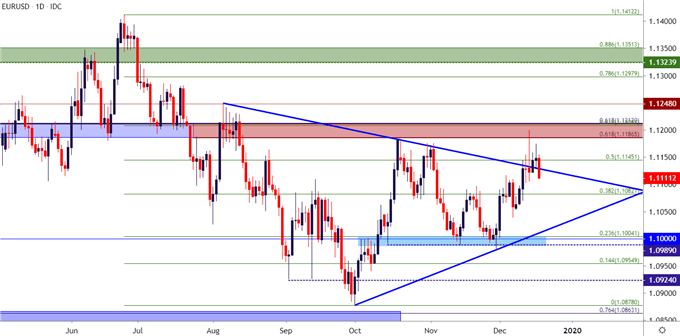

EUR/USD Holds Below Key Resistance Zone

The second-half of this year has been mostly compression in EUR/USD as price action had narrowed deeper into a symmetrical wedge pattern. Last week brought Christine Lagarde to the forefront for her first rate decision atop the ECB, and as she said during the event, she’s going to be her own person rather than trying to echo or reiterate policy parameters from ECB Presidents of the past. So this presents the prospect of change for the single currency, particularly as those prior ECB Presidents were unable to reverse the trends of slow growth and inflation despite multiple rounds of QE and negative rates.

EUR/USD quickly flickered up to a fresh four-month-high last week, albeit temporarily, as price action caught resistance in a longer-term zone of interest. That held the topside move at bay and prices are continuing to pullback from that resistance test. The big question now is whether buyers might remain vigilent enough to offer support around a prior level of interest, taken from around the 1.1100 handle. Just below that is another potential support area around 1.1082, and if that doesn’t hold, the next area of recent support is lodged around the 1.1000 big figure, which has held two different support tests over the past couple of months.

EUR/USD Daily Price Chart

Chart prepared by James Stanley; EURUSD on Tradingview

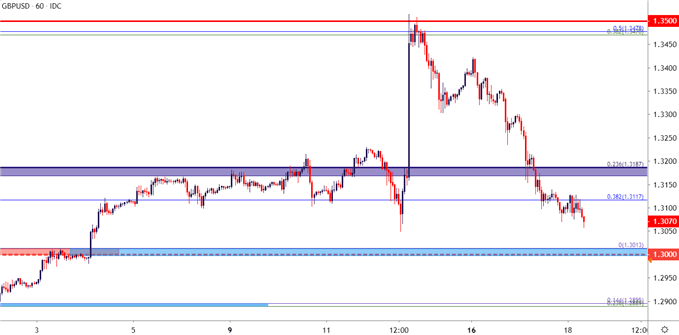

GBP/USD: Cable Crushed, Post-Election Gains Eviscerated

What goes up, must come down?

While the laws of Newtonian physics don’t always perfectly apply to price action (referring to the S&P 500 here), a pretty volatile backdrop has taken-hold in the British Pound, continuing what’s been an eventful year. Last Thursday’s post-Election run saw GBP/USD surge all the way up to the 1.3500 handle. Buyers even put in a couple of different tests around that level on Thursday night/Friday morning but were unable to create much push above that price. And then as the door opened to this final full week of 2019, prices came tumbling lower, with a big loss yesterday showing on the back of continued Brexit dynamics.

Similar to chasing the breakout on the way up, traders may face similar challenges in chasing the breakdown on the way lower. A big area of support potential may soon be nearing after buyers were unable to stem the declines at the 1.3187 area, and that next area of support comes in around a prior area of resistance at 1.3000. Given the quick moves and fast turns that have shown in the pair and, more precisely, the British Pound, the potential for swings and reversals can remain. Also of note, the Bank of England hosts a rate decision tomorrow morning and that can certainly help to keep Sterling on the move.

| Change in | Longs | Shorts | OI |

| Daily | -3% | 4% | -1% |

| Weekly | 3% | 2% | 3% |

GBP/USD Daily Price Chart

Chart prepared by James Stanley; GBPUSD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX