Australian Dollar Price Outlook Talking Points:

- AUD/USD is testing fresh decade lows that were set in August. Sellers were unable to make much ground below .6700 as a retracement developed in early-September.

- AUD/USD remains as one of the more attractive venues for long-USD exposure, a looked at in yesterday’s webinar on US Dollar price action.

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

AUD/USD Tests Key Support

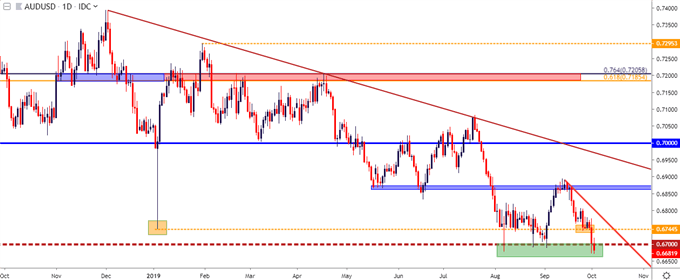

It’s been a rough year of 2019 for the Australian Dollar, and this extends a down-trend that’s been in-effect in AUD/USD since early-2018. Coming into the New Year, AUD/USD showed a ‘flash crash’ to slalom down to a low of .6744; but as risk aversion took a hiatus on the back of a dovish FOMC, the pair recovered for the next couple of months to a high of .7295. But after that high was hit in late-February, sellers came back and have continued to press as a down-trend has remained in-effect, eventually tagging fresh 10-year lows inside of the .6700 handle in early-August trade.

AUD/USD Daily Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

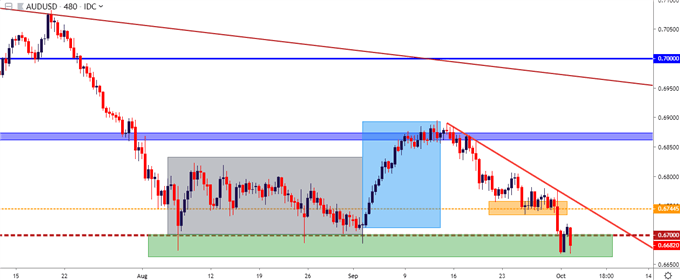

Breakdown to Fresh 10-Year Lows

In early-August that bearish theme in AUD/USD took on a new life as prices perched down to a fresh 10-year-low, finally breaking below the ‘flash crash low’ that showed earlier this year and eventually came back to show as short-term support. Sellers were able to dig all the way below .6700; but at that point selling pressure dried up and a couple of attempts later in August also failed to break-through, leading to a retracement in early-September up to a key zone of resistance on the charts.

AUD/USD Eight-Hour Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

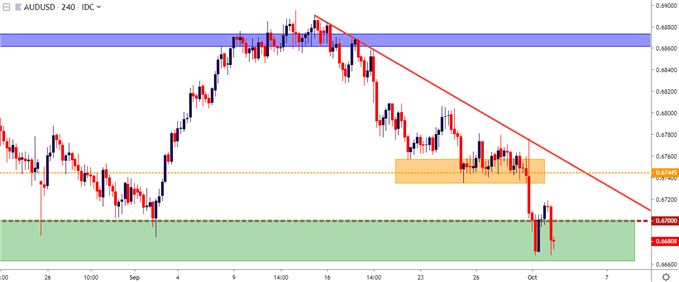

AUD/USD Sellers Return – Can they Retain Control?

As looked at in the webinar in mid-September, that retracement in AUD/USD had run into a key zone of resistance inside of the .6900 handle. As USD-strength began to get a bit more noticeable around the FOMC rate decision, AUD/USD began to tilt-lower, re-opening the door for bearish strategies. Prices quickly pushed right back down to the .6744 support level, the same that came in as support after the ‘flash crash’ earlier in 2019; and sellers continued to drive as that support was holding the lows, producing a short-term descending triangle pattern.

That bearish formation gave way earlier this week around the RBA and price action again jumped down for a test of support below the .6700-handle. And as looked at in yesterday’s webinar, sellers have so far persisted. But, similar to what showed in August trade, bears may want to be careful as there’s been a simple lack of downside drive in the current area on the chart. More enticing, however, could be a check-back to resistance at that prior area of well-defined support around the .6744 area on the chart which, as yet, hasn’t been tested for resistance.

AUD/USD Four-Hour Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX