US Dollar Talking Points:

- The US currency continues to carry a bid into the Q3 close, making a strong push towards re-testing the fresh two-year-highs that printed earlier in September.

- Can Dollar bulls retain control through the Q4 open? Throughout 2019 there’s been a tendency for USD bulls to pull back around fresh highs or resistance – is this the run that sees USD buyers take control for a re-test of the 100 level in DXY?

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

US Dollar to Two-Year-Highs Ahead of Q4 Open

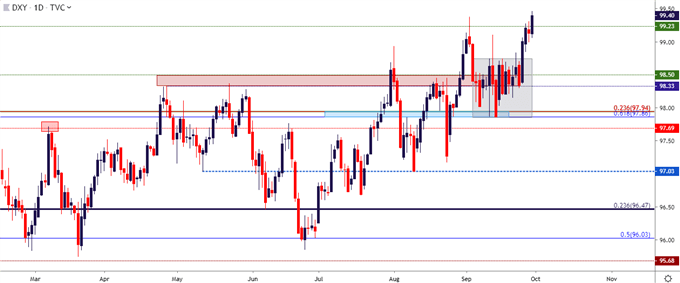

Today is the final day of Q3 and tomorrow brings the Q4 open, and the US Dollar is not waiting around as the currency has pushed up to a fresh two-year-high to extend the bullish ramp that started last week. The USD caught a bid last Wednesday and buyers have continued to push the bid ever since. There was a bit of pause to finish last week inside of the prior two-year-high, a level that was hit in early-September trade; but that strength has continued through the weekly open and the US Dollar is perched at fresh two-year-highs ahead of the start of Q4 tomorrow.

US Dollar Daily Price Chart

Chart prepared by James Stanley; US Dollar on Tradingview

EUR/USD Breaks Down to Fresh Two-Year-Lows

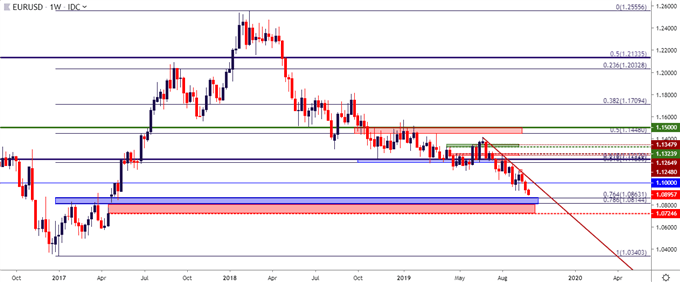

Going along with that topside USD-drive, EUR/USD has perched down to a fresh two-year-low. The big question here for Q4 is whether sellers can continue to drive? The fundamental backdrop has been fairly bearish on the Euro for some time, even extending back to last year’s Italian elections. But for the bulk of this summer the currency stubbornly refused to move lower as a series of bear traps appeared in EUR/USD; and this even ran through the ECB’s announcement of additional stimulus a couple of weeks ago.

But, with Q4 on the next page EUR/USD bears have taken-control to craft fresh two-year-lows. Just underneath current price action is a zone that was last in-play around those Italian elections in 2017. There’s also some unfilled gap that runs down to 1.0725, begging the question, how aggressive will sellers remain to be?

EUR/USD Weekly Price Chart

Chart prepared by James Stanley; EURUSD on Tradingview

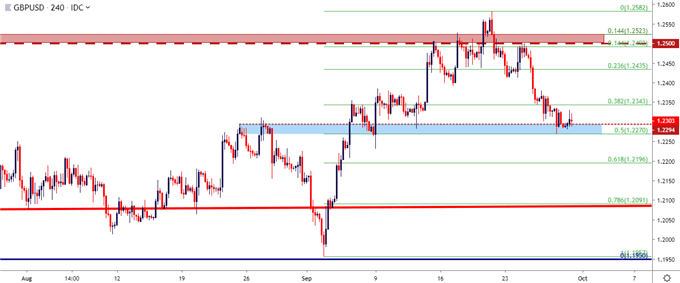

GBP/USD Pulls Back to Support After September Rally

This month saw a 500+ pip incline develop in GBP/USD, and this comes on the heels of a rather aggressive sell-off that spanned from April into August. In early-August, support developed around a long-term trendline that finally helped to cauterize the lows in the pair. But this recent rout of USD-strength has taken its toll on the matter, crafting a 50% pullback of that prior bullish move; begging the question as to which trend will take-over in Q4 as ‘Brexit day’ fast approaches.

GBP/USD Four-Hour Price Chart

Chart prepared by James Stanley; GBPUSD on Tradingview

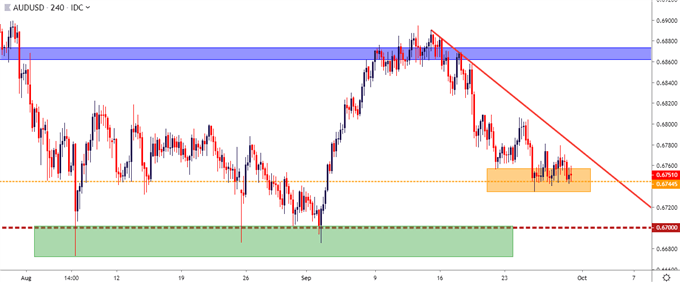

AUD/USD Breakdown Potential for Q4

For strategies around USD-strength, AUD/USD remains a compelling option going into the final quarter of the year. Similar to GBP/USD looked at above, the longer-term bearish scenario remained in-effect through the early-portion of Q3, driving the currency down to fresh lows as USD-strength remained visible. And also similar to GBP/USD a retracement showed in early-September trade as shorts were squeezed. The big difference between the two pairs is that sellers were quicker to react in AUD/USD to amount for a more shallow retracement while GBP/USD buyers continued to push the bid until last week’s USD rally showed.

AUD/USD Four-Hour Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

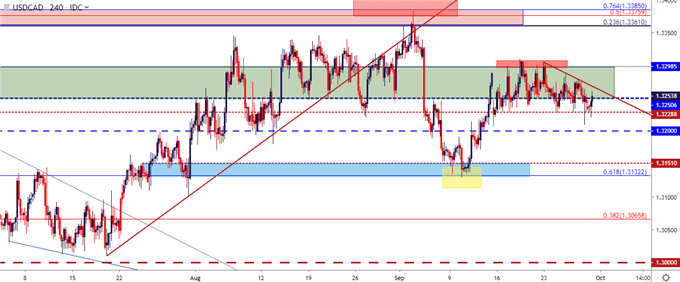

USD/CAD of Interest for Bearish-USD Strategies

On the other side of the US Dollar, USD/CAD can remain of interest. Even with the US Dollar jumping up to fresh two-year-highs, USD/CAD continues to show near-term bearish tendencies, holding a resistance zone whilst making lower-highs. If USD-weakness does come back, the short-side of USD/CAD could be an attractive spot to follow.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX