Gold Price Outlook Talking Points:

- T he bullish trend in Gold prices is on the back foot as a strong pullback has developed in the closing days of Q3.

- While a portion of this can likely be attributed to window dressing, the strong bullish push in the US Dollar syncs with this move and, at this point, may have aim of continuation for the next couple of days as quarter-end draws closer.

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Gold Prices Snap Back Ahead of Q4 Open

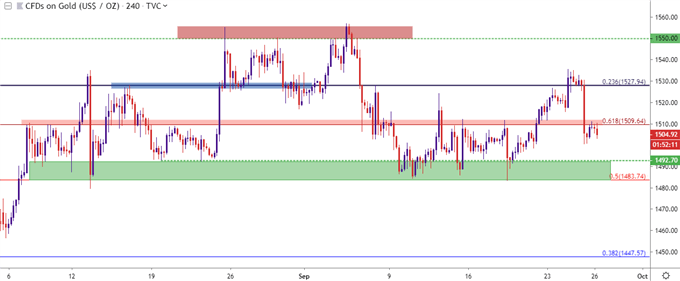

It’s been another strong quarter for Gold prices and with two trading days left before the end of Q3, a pullback has shown up. While this may be attributed more to end-of-month and end-of-quarter flows, Gold prices are still showing overbought readings via RSI on the weekly chart and as discussed in these Gold technical pieces in the recent past, a deeper pullback can make the prospect of longer-term bullish trends as more attractive. The big question now – how deep will that pullback go and when might bulls be ready to jump back in?

At this point, Gold prices are holding above the 1500 level of psychological support while showing a bit of short-term resistance from a familiar Fibonacci level at 1509.64. This is the 61.8% retracement of the 2012-2015 sell-off in Gold and has most recently come-in as near-term resistance a week ago.

Gold Four-Hour Price Chart

Chart prepared by James Stanley; Gold on Tradingview

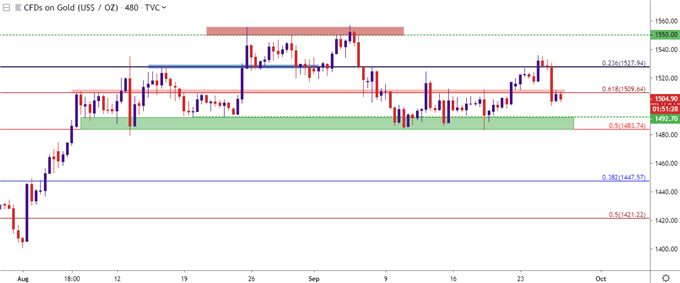

Gold: How Deep Can Sellers Push?

For all intents and purposes, the bulk of this quarter’s bullish move showed up in early-August, just after the FOMC rate cut and as tensions with China were continuing to rise. That pushed Gold prices all the way above the 1550 level, which was tested thrice, each of which failed. Since then, prices have returned for multiple iterations of support in the area that runs from 1483.74-1493. This highlights the fact that more than half of Q3 has seen range-bound behavior in Gold prices, even with the strong bullish bias as brought upon by the fundamental and monetary backdrop. The big question here is whether this end-of-the-quarter pullback can test through that longer-term zone of support that’s built-in over the past seven weeks? At this point, that support can remain attractive for bullish strategies.

Gold Eight-Hour Price Chart

Chart prepared by James Stanley; Gold on Tradingview

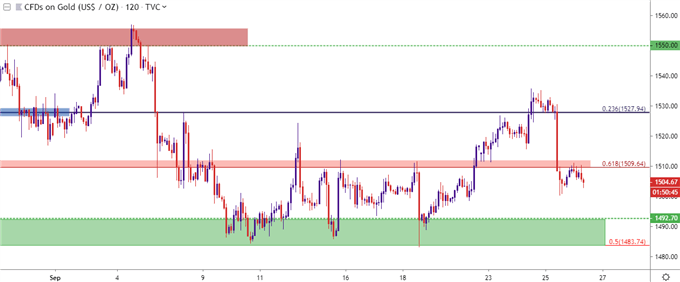

Gold Prices Bearish Strategies

Given the proclivity towards bullish themes in Gold, combined with the backdrop that’s produced them, traders still may want to move forward with a longer-term bullish bias on the matter.

However, given the short-term resistance combined with the longer-term overbought nature, added to the end-of-quarter backdrop, and there could be scope for short-term bearish scenarios, looking for prices to drop from the current area of Fibonacci resistance down for a test of longer-term support in the zone investigated above. Traders would likely want to couple that approach with relatively tight stops in the event that another bullish flare does develop so that losses could be mitigated as the grander trend takes over.

Gold Two-Hour Price Chart

Chart prepared by James Stanley; Gold on Tradingview

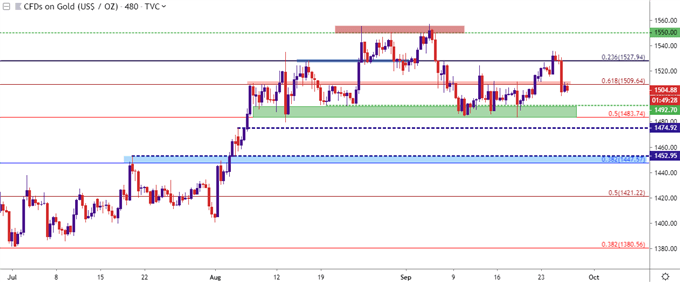

Gold Bigger Picture Strategy

At this point, the fear of a hawkish Fed doesn’t really appear to be much of an issue. The big question around the FOMC for Q4 is if they cut rates again or whether they punt that decision into Q1/Q2 of 2020. This can keep motive for bullish biases for longer-term approaches, and as discussed in these pieces in the very recent past, there are a number of potential support levels of a longer-term nature that could be of interest should they come into play. And the fact that a pullback is showing ahead of quarter-end may be that scenario that brings that opportunity.

Looked at above is a very obvious zone of support that’s been in-play over the past couple of months, but a bit deeper brings another couple of levels that remain of interest. Specifically, areas around 1475 and 1450 provided some element of resistance when prices were on the way up but, as yet, haven’t shown much for support since the bullish trend sliced through each price in early-August trade.

The 1475 level, while nearby, would offer the luxury of taking out trailed stops that are likely sitting just below the current zone of support. The 1450 area, on the other hand, is very near another Fibonacci level of relevance at 1447.57, which could help to build a zone of potential support to look to for a bigger-picture pullback scenario.

Gold Eight-Hour Price Chart

Chart prepared by James Stanley; Gold on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX