Gold Price Outlook Talking Points:

- Gold prices put in a strong day of price action yesterday, going along with a number of key risk markets after FOMC Chair Jerome Powell took on a dovish tone in yesterday’s remarks on Capitol Hill.

- This helped a number of key risk markets post strong bullish moves, including the S&P 500 crossing above the 3k barrier. More interestingly, Gold prices have so far pulled up short of their prior highs, indicating that Gold bulls might not yet be ready to push prices up to a fresh six-year high-watermark.

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Gold Prices Glitter After Powell Comments

Gold bulls posed another topside push yesterday on the heels of some dovish comments from FOMC Chair, Jerome Powell. This helped Gold prices to push back above the 1400 marker after a two-week pullback from the fresh six-year-highs that were set in late-June. Yesterday’s risk rally was fairly wide-spread, with global stocks catching a bid as the S&P 500 set a fresh all-time-high above the psychological 3k level. Noticeably, however, that bullish theme in Gold prices was a bit more subdued as buyers pulled back short of last week’s swing-high, showing resistance in a key zone on the chart that’s thus far been able to restrain the advance. This indicates that more digestion of the late-Q2 breakout may be in order before buyers are ready for fresh highs in the yellow metal.

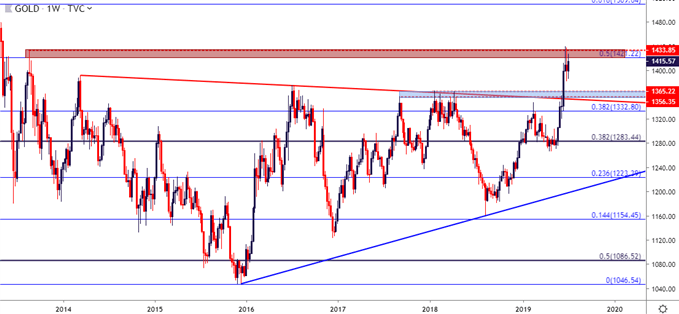

Gold Weekly Price Chart

Chart prepared by James Stanley

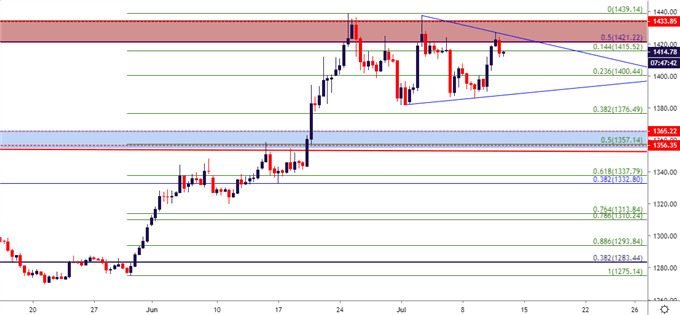

Taking a closer look on the chart, and this recent round of digestion can make sense as part of the bigger picture. Yesterday’s lower-high is coupled with a higher-low that showed-up on Tuesday has led into a symmetrical wedge pattern. Given the prior bullish trend, this shows as a bull pennant formation, which offers a bit of bias potential to that otherwise non-directional symmetrical wedge. This can keep emphasis on the bullish side of Gold for as long as prices remain above trend-line support.

Gold Price Eight-Hour Price Chart

Chart prepared by James Stanley

Gold Price Strategy

Timing is of importance here and given the lack of fresh highs in Gold as risk markets elsewhere were showing significant gains, there remains potential for an extension of consolidation. At this stage, Gold price action is testing below the 14.4% Fibonacci retracement of last month’s bullish move while also seeing resistance at a key area on the chart. For those that want to retain an aggressive stance, expecting a near-term breakout, this may be a usable support level if buyers can hold the line through today’s trade. However, a bit deeper is another area of interest of that same theme that could allow for a bit more of a prudent approach, and this comes in around that 1400 psychological level, which is confluent with the 23.6% retracement of that same major move.

On a longer-term basis, or for traders that would prefer to take a further step back, bigger-picture support potential remain at the same zones looked at last week; taken from the 38.2% and 50% markers of that recent major move, each of which offers a bit of confluent support potential on the chart.

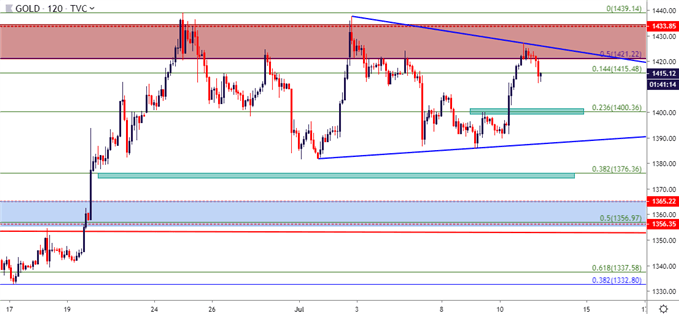

Gold Price Two-Hour Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX