Euro, EUR/USD Talking Points:

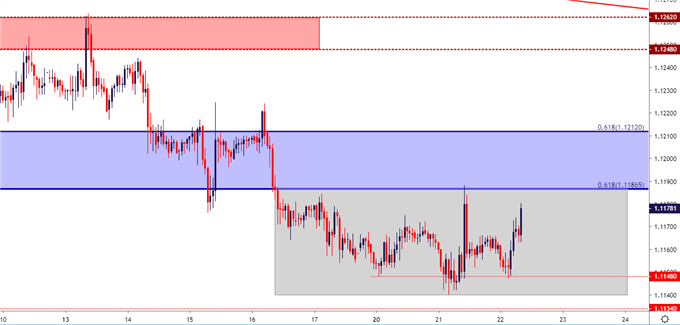

- EUR/USD has spent the early portion of this week in a tight range of approximately 50 pips, including yesterday’s flare of strength that fell flat at the 1.1187 Fibonacci level.

- Tomorrow brings the start of European Parliamentary elections, and this range is vulnerable to give way. Also of interest around the Euro for tomorrow is the release of meeting minutes from the bank’s most recent rate decision. Our own Martin Essex has already produced a primer for upcoming European elections.

- DailyFX Forecasts are published on a variety of currencies such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Do you want to see how retail traders are currently trading the Euro? Check out our IG Client Sentiment Indicator.

Euro Range Tightens, EUR/USD Builds into Box

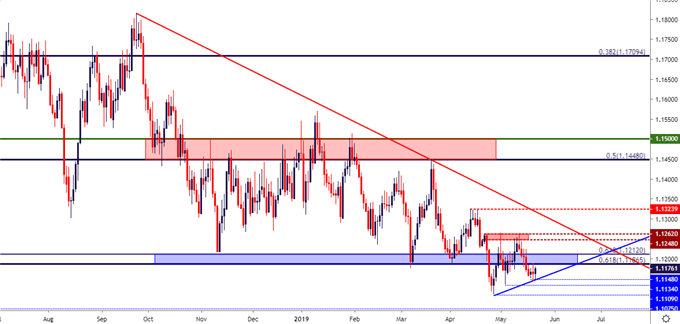

The Euro has put in an impressive lack of momentum so far this week as traders await the start of European elections tomorrow. After prices in EUR/USD fell back-below the big area of support that had held the lows in the range for six months, the door appeared opened for bearish continuation coming into this week. But, after considerable grind around the 1.1150 level, prices have tilted-higher to leave yet another higher-low on the chart.

Given the drivers on the horizon, it can make sense as to why there’s so far been a lack of momentum. This round of European Parliamentary elections is being seen as a debate on populism in Euro politics, the ramifications of which will help to mold policy in the bloc for years to come. This sets the stage for breakout potential in the single currency, and this weekend will likely bring gap-potential in the Euro as elections run into Sunday.

EUR/USD Hourly Price Chart

Chart prepared by James Stanley

Taking a step back, this week’s indecision currently shows as two completed doji’s on the daily chart with today’s price action showing something similar. Notable, however, is the fact that sellers have thus far been unable to pose a break below the 1.1100 level, and this comes despite a number of bearish drivers that have availed themselves around the currency over the past seven months. This includes a populist theme in Italy that threatened a debt stand-off between Brussels and Rome, as well as the March announcement of fresh TLTRO’s from the ECB.

Will European Parliamentary Elections be the driver that bears have been looking for that may finally elicit a break down to the 1.1000 level or, perhaps even further? Or, is this setting up to be a massive bear trap as sellers have had ample opportunity to take-control of the matter but, to date, haven’t?

EUR/USD Daily Price Chart

Chart prepared by James Stanley

EUR/USD Strategy: Levels to Know

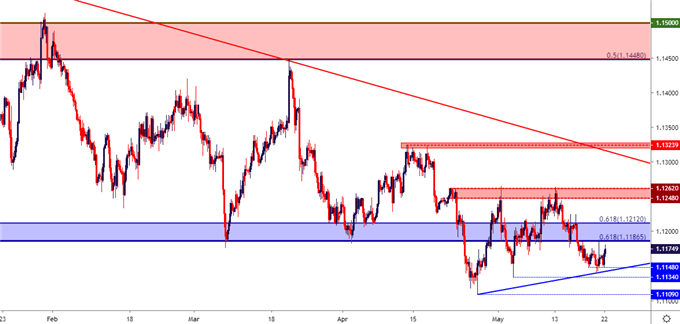

Given the potential for a spike in volatility, and traders would likely want to try to adapt their approach as the coming days may lead to sharp moves in the single currency. This can make breakout themes more attractive than trends, at least in the near-term, as new drivers are getting priced-into the matter. And given the digestion seen around the current spot on the chart in the recent past, there are a plethora of possible levels to use for such a purpose.

Above current prices, the big zone of prior support lurks from 1.1187-1.1212, with the former price coming into play yesterday to help to set this week’s high. Above that, the prior resistance zone looked at earlier in the month runs from 1.1250-1.1262, and above that, the 1.1325 level remains as the two-month-high in the pair. If buyers can push a break-beyond that level, the area of prior range resistance comes into the equation, and that runs from 1.1448-1.1500.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley

For support potential underneath current prices, the weekly chart will be required as EUR/USD hasn’t traded below the 1.1100 handle in two years. Traders can incorporate each of the recent higher-lows for shorter-term support variables, and those show at 1.1134 and 1.1109. Below that – the 1.1075 level may offer a nearby point of interest, and the 1.1000 psychological level is below that. If sellers can pose a large push around these upcoming drivers, a longer-term zone of interest remains in the area from 1.0814-1.0863. Below that 1.0814 level exists some unfilled gap from April of 2017, and that extends all the way down to 1.0730, which could be incorporated into the approach in the event that Euro bears make an aggressive short-side push.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX