US Dollar Holds Trend-Line Support Ahead of Powell, US NFP’s

US Dollar Talking Points:

- US Equities are starting December in a very bullish way, gapping-higher to start the final month of the year following some positive comments at the G20 meeting this weekend. The potential for calm developing around trade tariffs has bulls on the bid, and the Dow Jones Industrial Average is making a run at 26k after opening last week around 24,300.

- FX markets are moving rather slowly in comparison to equities, and there may be a bit of congestion to work through in the early-portion of this week. The latter portion of the week, however, brings a series of US drivers that can continue to push the Dollar. Wednesday sees American financial markets close for an official day of mourning for the death of former US President, George HW Bush. This is also the start of Jerome Powell’s semi-annual Humphrey Hawkins testimony, in which he’ll provide testimony on Wednesday morning before fielding questions from Congress. Powell speaks to the House on Thursday, and Friday brings Non-Farm Payrolls; so the US Dollar will likely remain in-focus into the end of this week’s trade.

- DailyFX Forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment Indicator.

A Bullish Weekend for Stocks

Opening December price action brings a theme of optimism, as news this weekend of thawing relations between Beijing and the United States have helped to propel equity prices higher. US equities are starting the month with a big move of strength following this weekend’s developments at G20. Both President Trump and President Xi agreed to hold off on tariff increases, signaling a potential pivot in a theme that’s only worsened over the past couple of months. This is a market pressure point finding calm after another similar instance took place last week around rate hikes out of the United States; and this came from testimony from FOMC Chair Jerome Powell.

Mr. Powell will remain in the news this week as Wednesday and Thursday bring the semi-annual Humphrey Hawkins testimony in-front of Congress. This will begin with testimony from the Fed Chiar, followed by questions from Congress. On Wednesday, Mr. Powell speaks to the Senate Finance Committee and on Thursday he’s in front of the House Financial Services Committee. This leads into the Friday release of Non-Farm Payrolls, making for an especially busy economic calendar in the latter-portion of the week for US traders.

Also of concern – American financial markets will be closed on Wednesday for an official day of mourning for former US President, George H.W. Bush. This includes the New York Stock Exchange, Nasdaq equities and options markets, CME Group’s equity and rates markets and the CBOE’s Global Markets exchanges. This can lead to especially volatile over-the-counter markets on Wednesday to go along with the potential for large moves around the US open on Thursday.

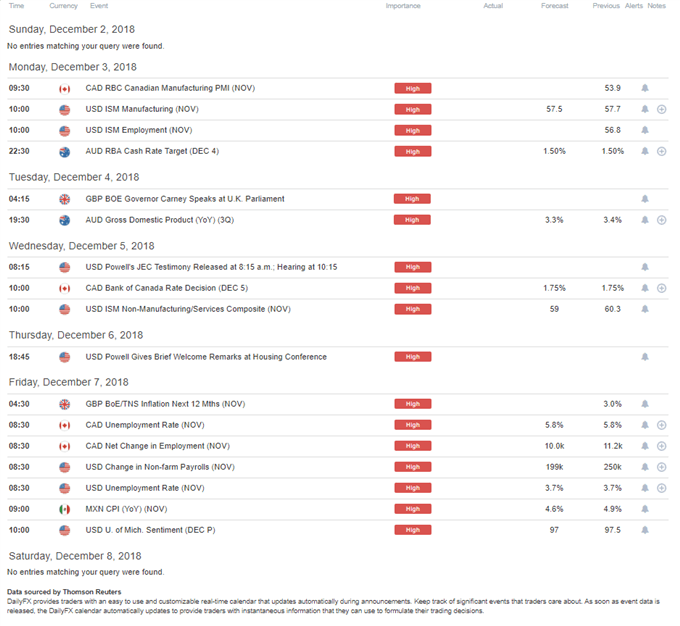

DailyFX Economic Calendar: High-Impact for the Week of December 3, 2018

US Dollar Drops at Open, Finds Support Around Trend-Line; Unfilled-Gap Remains

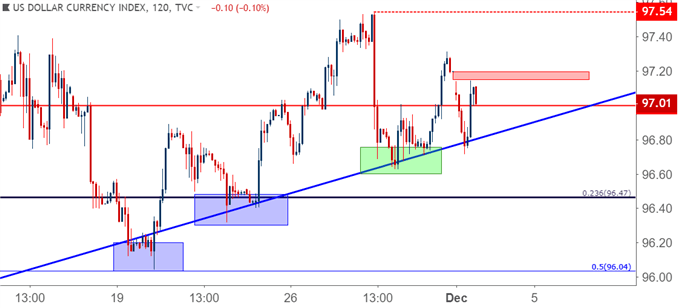

Going along with that risk-on tone after the Sunday open, the US Dollar gapped lower and continued to sell-off through the Asian session. Prices trickled back-down to the bullish trend-line that had come back into play again last week, where a bit of a bounce has started. That bounce may have a bit more room to run, as there remains a portion of unfilled-gap from this weekend’s open.

US Dollar Two-Hour Price Chart: Unfilled Weekend Gap Remains

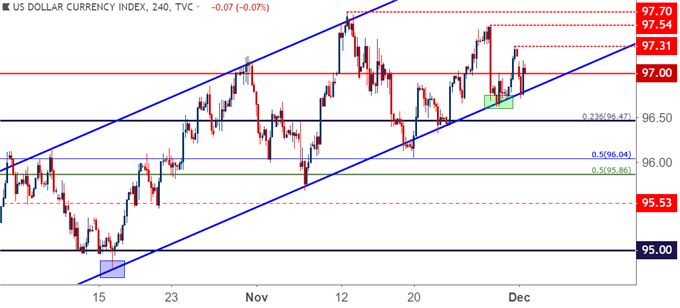

The big question is whether bulls can challenge swing-highs around 97.30 and 97.50, the latter of which was the lower-high that came into play around Chair Powell’s testimony last week. If prices do test above this level, the door for bullish continuation remains open with targets set for a test of the yearly high around 97.70. But – if buyers fail to test through, the door may soon be opening for USD-weakness strategies as a series of lower-highs continues to build in.

US Dollar Daily Price Chart: Are Dollar Bulls Running Out of Steam?

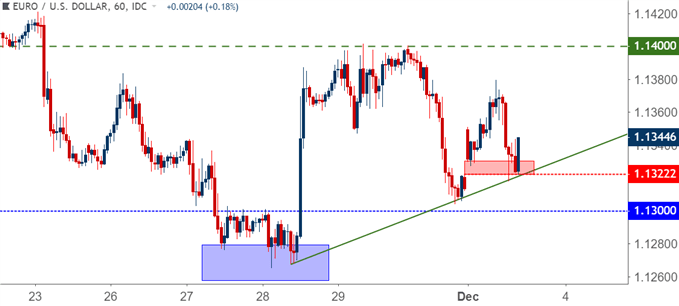

EUR/USD Fills Gap As Higher-Lows Continue to Build

Going along with that gap-lower in the US Dollar was a gap-higher in EUR/USD, as the pair opened Sunday trade at the 1.1350 handle, quickly dropping by 20 pips before buyers stepped-in to push prices back-up to 1.1375. Around the European open is when sellers stepped up to the plate, and EURUSD price action quickly filled whatever unfilled gap was remaining; and prices now appear to be trying to cauterize support around the 1.1325 area on the chart.

EUR/USD Hourly Price Chart

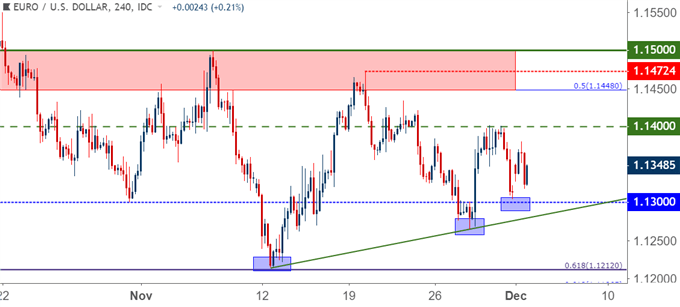

The big question around the Euro at the moment is whether a bigger-picture reversal setup might be brewing. The final three weeks of November saw a build of higher-lows and this comes despite a plethora of reasons for sellers to continue to push. They didn’t, and those higher-lows have built-in, begging the question as to whether the pair has much short-side potential left without some additional motivation brought upon by the developing scenario around Italy and the European Commission.

Key for this theme will be defense of last week’s swing-low around 1.1266. This came-in ahead of that Powell speech, after which EUR/USD jumped up to the 1.1400 handle, at which point bulls were simply unable to make more ground. Since then, we’ve had a hold of higher-low support; and if we see continued defense of the lows, a deeper move of strength may soon be in store.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q4 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers a plethora of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX