Talking Points:

- The Greenback has recovered a bit from the gap-lower that started the week. A trio of Fed-speakers on the docket for today could keep prices moving as investors attempt to gauge just how hawkish the Fed might be for the remainder of the year.

- The U.S. Dollar is back to the 50% marker of the post-Election move, and this can open the door to both bullish and bearish scenarios for the Greenback. Below, we look at two setups on each side of that coin.

- If you’re looking for trading ideas, check out our Trading Guides. And if you’re looking for ideas that are more short-term in nature, please check out our Speculative Sentiment Index (SSI) Indicator.

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Coming into the month of March, there were few expectations for a rate hike at the Fed’s meeting in the middle of the month, with probabilities hovering at around 30-40%. But as various Fed speakers talked up the prospect of three hikes in the calendar year of 2017, the idea of a move in March seemed much more likely; and as we finally approached that rate hike, expectations for an adjustment were fully priced-in and then some; so much so when we finally got that hike, the U.S. Dollar dropped in value and continued doing so for the next two weeks, bringing us to today.

The Greenback opened this week by gapping-lower after the AHCA failure in the House of Representatives. But as we warned yesterday, the Greenback had gapped-down to a critical support level as the 61.8% Fibonacci retracement of the ‘Trump Bump’ in DXY. Support has showed-up, and this additional demand at those lower prices has brought price back-up to a prior point of support; right around the 50% retracement of that same post-Election move.

Chart prepared by James Stanley

This leaves the Dollar at an interesting ‘decision level’, as attractive setups could be available on both the bullish and bearish side of the U.S. Dollar. Below, we investigate setups for each.

On Monday we talked about the big zone of support in USD/JPY at around the 110.00 level, as this is a major psychological level and just ten pips below, we have the 50% retracement of the ‘Trump Bump’. But more to the point – the way that traders responded to this level this week was what would likely be most telling, as we’d seen support build ahead of that zone after prices gapped-lower to open the week; and a subsequent re-test yesterday saw a short-term ‘higher-low’ build. This is still in the early stages, but for those looking to gain long-USD exposure, this can be an interesting area as stops can go below that zone of support in the effort of looking at top-side continuation.

Chart prepared by James Stanley

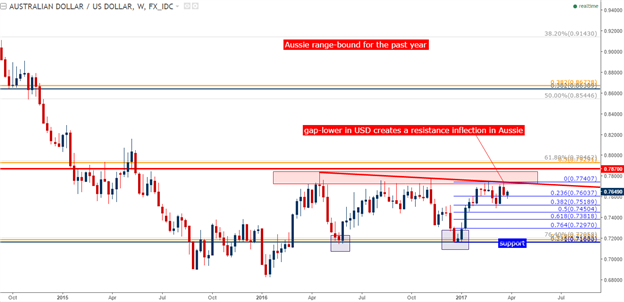

Another interesting spot for long-USD exposure can be seen in the Aussie. AUD/USD has been range-bound for almost a full year now. This week’s gap-lower in the U.S. Dollar sent Aussie back into this zone of resistance, at which point sellers have responded. At the very least, such a setup could offer a defined-risk setup with that year-long zone of resistance; and if USD strength does come-back as a predominant theme, the next side of this range could fill in fairly quickly while offering 1-to-2 risk-reward ratios or more.

Chart prepared by James Stanley

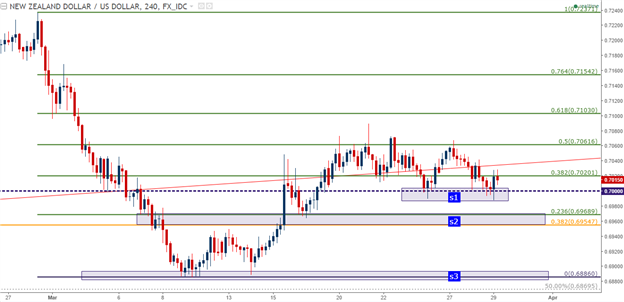

On the alternate side of that coin we have the Kiwi-Dollar, which could be attractive for short-USD exposure scenarios. NZD/USD continues to catch some element of support around the big figure at .70000, and below we have a fairly robust support structure to plot top-side continuation strategies.

Chart prepared by James Stanley

This one might be a bit more tenuous as it appears as though we’re seeing the introduction of a new theme with the possible tightening of policy from the ECB in December of this year when the ECB QE program is set to expire. This week’s gap-lower in the Greenback created a new short-term high in EUR/USD, but after Brexit was triggered this morning, we’ve seen Euro-weakness come into the fray. We’re seeing current support develop in EUR/USD at approximately 38.2% of the most recent bullish move-higher. A bit lower, at the 50% retracement of this most recent move, we have a confluent level of potential support around 1.0700, and this can help with stop placement on long EUR/USD setups in the effort of top-side trend-continuation.

Chart prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX