Talking Points:

- Japanese markets continue to move in the direction of the apparent pricing-in of even more Japanese stimulus. And while little is known at this very early stage, anticipation of Central Bank action and stimulus has been one of the biggest drivers to financial markets in the post-Financial Collapse environment.

- This rising tide may have the power to lift the boats of international equity markets as well, at least in the near-term, as prior rounds of Japanese stimulus have been directed towards purchasing international stocks. The fresh all-time high set on the S&P 500 yesterday speaks to this theme.

- If you’re looking for trading ideas, check out our Trading Guides. And if you want something more short-term in nature, check out our SSI indicator. If you’re looking for an even shorter-term indicator, check out our recently-unveiled GSI indicator.

To receive James Stanley’s Analysis directly via email, please sign up here.

In yesterday’s article we wrote about the prospect of even more Japanese stimulus after Prime Minister Shinzo Abe’s Conservative party won a super-majority in the upper-house of Parliament. As we mentioned yesterday, this type of theme could have near-term staying power as markets attempt to front-run or anticipate the eventual announcement of more stimulus. Abe had previously pledged that a ‘comprehensive, bold economic stimulus package’ was coming this fall. This weekend’s elections make that more-likely to happen.

And while nobody can be certain about what the Bank of Japan might actually have in store, front-running Central Bank actions has been one of the most attractive themes of the post-Financial Collapse economic environment. Central Banks have embarked on a path of transparency that attempts to telegraph to market participants the future actions of some of the biggest players in the world (CB’s, themselves). So, as long as Central Banks are enable to embark on aggressive easing programs, and as long as they’re openly telegraphing their intentions, investors and traders will likely continue to try to get in front of these actions.

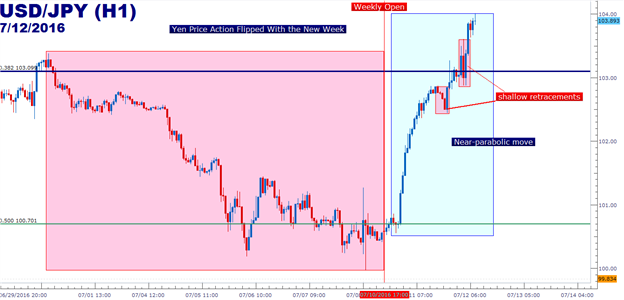

On the chart below, we look at the about face that’s happened with Yen price action on this week’s open. A stark down-trend in USD/JPY has flipped into an aggressive up-trend with very little give-back, indicating just how aggressive the bid has been.

Created with Marketscope/Trading Station II; prepared by James Stanley

This could have global repercussions, as the Bank of Japan has been using QE to purchase global stocks for the better part of 20 months now. Even more stimulus out of Japan would likely entail Yen weakness and some element of strength in equity markets around-the-world as one of the biggest global players looks to acquire even more stocks. On the heels of this weekend’s elections, in which it became obvious that we’ll likely be seeing more Japanese stimulus, the S&P 500 rocketed up to a fresh all-time high. This was probably not a coincidence.

As a signal of just how strong this anticipation might be, we’ve seen the S&P 500 move higher by 18.7% in just five months. And nothing ‘great’ has happened for the global economy in the past five months other than markets taking a step back from the ledge in the early portion of the year. Earnings for US companies continue to signal slowdown, US economic data has been patchy, at best, and we’ve just seen one of the largest economies in the world begin discussions to divorce itself from its supra-national government. The one consistent theme over the past five months has been Central Banks supporting markets either with dovish commentary or pledges of future action.

Created with Marketscope/Trading Station II; prepared by James Stanley

For traders looking to get in-front of potential Bank of Japan action

There are a few markets that will likely remain primed with volatility as we see markets pricing-in the prospect of even more Japanese stimulus. As mentioned above, that stimulus may likely be directed at global equity purchases; but if history is any guide we’ll likely see more of those stimulus funds directed towards Japanese issues. So traders looking to trade this theme in the equity space could look to Japanese indices such as the Nikkei or the Topix. On the chart below, we’re looking at the long-term Monthly chart of the Nikkei, and notice how the past five months of price action has continued to catch support around the 38.2% Fibonacci retracement of the 2009 (low) -2015 (high) move.

Created with Marketscope/Trading Station II; prepared by James Stanley

And on the following chart, we toggle down to the daily to look at how traders might be able to trigger-in to the long-side of the move with recent price action.

Created with Marketscope/Trading Station II; prepared by James Stanley

Such a strategy could be adopted to the Yen as well. EUR/JPY has put in an especially sharp move over the past two days, and is currently working with an interesting level of resistance. The chart below goes over a potential game plan to look at selling the Yen against the Euro using recent price action.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX