Talking Points:

- Most equity markets are continuing their rallies that had begun last Friday. No real fundamental or macro changes have been evident as of yet.

- The S&P has put in a screaming rally over the past two trading days (Friday and Tuesday), leading many to ask the question of whether a bottom has been set despite the fact that we printed fresh lows on Thursday. This is a quandary that traders will continue to face, and we discuss that below.

- If you’re looking for ‘big picture’ macro ideas and technical setups, check out our Trading guides, which include the DailyFX Q1 forecasts along with our ‘Trades of the Year.’

- For trade ideas, our positioning indicator can provide considerable information. This is the real-time outlay of FXCM clients across major markets at any given point in time, and it’s free at this link.

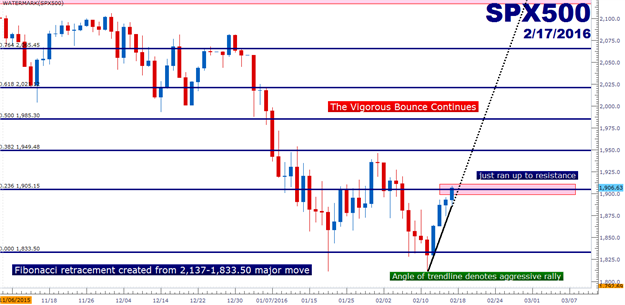

Rebounds Still Running as Stocks Continue Clawing Back – the retracements that we mentioned yesterday are continuing in most equity markets. The Shanghai Composite is working at a 3-week high, and the S&P has just run into another significant level. Yesterday we noted the 1,875 region as an area of interest, and price action gave a vigorous bounce off of this support yesterday.

The continued strength of stocks on the back of this four-day rally has many asking if we’ve hit a bottom. Perhaps we have, but more likely we haven’t. The fact of the matter is that the answer to that question will never be apparent until it’s far too late. This is the beauty of price action: It equalizes and strips out the insignificant from the pertinent. And the fact of the matter is that markets will often lead data, and will lead many of these events that many are watching for as signs or evidence of slowdown. The very act of calling a recession a ‘recession’ requires two consecutive quarters of slower growth. So by the time we recognize a recession, we’re already at least two quarters in one. So be careful with big picture prognostications here. Perhaps we see a global recession and perhaps we don’t, but again, this is irrelevant to the matter of a trader.

While the answers to these types of superfluous questions could be helpful, the fact that an accurate answer is unavailable should compel a trader to just save their time and instead focus on what matters. And what matters is price: Because this is the manifestation of a market’s opinion on a given asset at a given time, and perhaps more importantly – the price is what will stop you out or create margin calls, and when you’re right, price is what will produce. This is why risk management is so utterly important: Because when a trader is inevitably wrong, which will happen because markets are unpredictable and it’s simply not possible to call every top or bottom in a market, traders must control the damage when they’re wrong so that they can move on to greener pastures in order to be ‘right.’

The pertinence of this at the moment is the fact that the S&P is putting in conflicting signals depending on the time frame that you’re looking at it. If we look at the longer-term chart, the down-trend is undeniable, and this most recent rip higher makes short positions over the next few days look really attractive should resistance come in. That longer-term S&P chart is below.

Created with Marketscope/Trading Station II; prepared by James Stanley

But if we scroll down to a lower time-frame, that most recent rally is going to look really strong. Price action is continuing to work higher in this aggressively-sloped channel. Given the previous down-trend and the fact that prices are still subdued below the previous swing high in the 1,950 region, this would still be a bear-flag formation.

But what makes this interesting, and perhaps even slightly more bullish on a shorter-term chart is this level at 1,905.15, as this was the 23.6% Fibonacci retracement from the prior major move. This level has seen considerable price action since the Fibonacci retracement was formed in August of last year. Price action has just budged above this level of resistance and is now coming in as short-term support. But watch this level today, as this could provide that excuse that sellers need to jump back in to drive the trend lower.

Created with Marketscope/Trading Station II; prepared by James Stanley

So, long-term this is bearish with a setup to get short and short-term, this is rather bullish. What is a trader to do?

Well, this is where you come into play. Because there isn’t a right answer here, it all goes back to that non-predictability of future prices. The fact of the matter is that both of these directions can be traded, even at the same time provided that the trader is managing their risk properly.

As in, short-term we have a bullish formation from this upward sloping trend-channel, denoted by higher-highs and higher-lows on the hourly chart. The trader can look to ride that trend by placing stops under the prior-swing low while taking the trend higher, and should that ‘higher-low’ get broken, then we have the potential for a return of the down-trend. This is when the trader eats a stop and then gets ready for the short position.

Once the trend-channel/bear-flag is broken, this is when the trader wants to begin looking for ways to sell resistance.

The one aspect of importance is that the trader doesn’t ‘marry’ a side of the market and just sit in the position until what they were hoping would happen, happens. Because as we’ve outlined, market turns will often take time and, even with that time these turns are volatile and unpredictable.

The key to trading is survival. Because as long as you can survive, you can continue putting yourself in positions to place strong trades. But if you let just one or two ideas evaporate your equity, well you may end up out of the game in very short order.

The setup on the chart is undeniable. We have a down-trend. And more recently, we have a retracement in that down-trend pushing prices higher. Now that retracement may continue higher, and it could perhaps become a full-on up-trend. But again, as traders we don’t know that. We don’t have the luxury of crystal balls that actually ‘work.’ We have to trade what the chart gives us, and right now that’s a screaming short-term up-trend.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX