Check out the brand new DailyFX trading forecasts for Q3

MARKET DEVELOPMENTS – AUD UP ON US-CHINA TRADE TALK RESUMPTION

USD: A slight pullback for much of the morning for the USD from yesterday’s gains which had been driven by the balance sheet reduction, leading to a net negative liquidity impact of around $13bln and thus prompting a bid in the greenback. Softer US data this morning had also added to the pullback in the Dollar in which the Philly Fed business index fell to the lowest level since November 2016. However, the greenback has recently seen a slight bounce back following coordinated comments by President Trump and NEC Director Kudlow who both embraced a stronger dollar.

GBP: Strong retail sales underpinned the Pound, which rose to a high of 1.2730. Although, the 1.7bln option expiry has kept GBPUSD magnetised around 1.27, while EURGBP resides around the 1bln option expiry at 0.8950.

AUD: The Australian Dollar is among the best performers today following reports overnight that China and US trade talks are set to resume at the end of the month. Consequently, providing a boost for risk assets and high beta currencies. Although, further gains in the pair has been capped by the sizeable option expiry sitting at the 0.73 handle, while the level at which the US-China trade talks (Chinese Vice Commerce Minister and Deputy Treasury Secretary) are to be held, imply that issues to be resolved will take some time.

DailyFX Economic Calendar: Thursday, August 16, 2018 – North American Releases

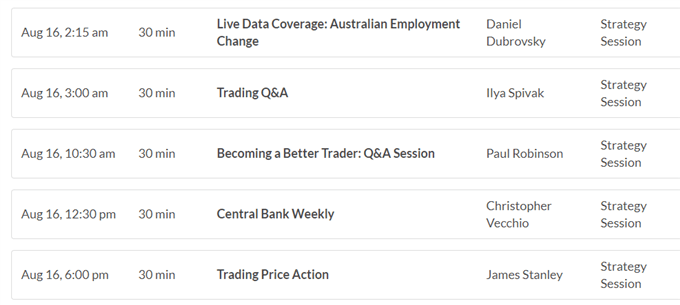

DailyFX Webinar Calendar: Thursday, August 16, 2018

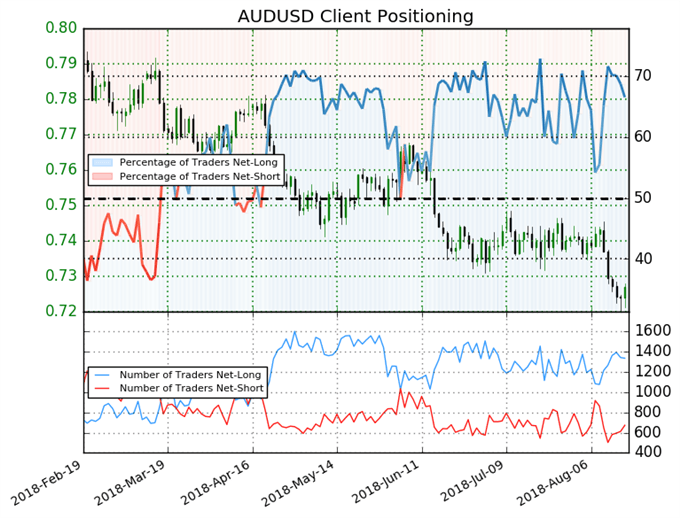

IG Client Sentiment Index: AUDUSD Chart of the Day

AUDUSD: Data shows 66.5% of traders are net-long with the ratio of traders long to short at 1.99 to 1. In fact, traders have remained net-long since Jun 05 when AUDUSD traded near 0.75575; price has moved 3.8% lower since then. The number of traders net-long is 4.9% lower than yesterday and 23.9% higher from last week, while the number of traders net-short is 8.9% higher than yesterday and 26.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed AUDUSD trading bias.

Five Things Traders are Reading

- “US Dollar Strength Pulls Back, EUR/USD Bounces From Yearly Lows” by James Stanley, Currency Strategist

- “EURUSD Price Analysis: Rebound to Hit Resistance Shortly" by Nick Cawley, Market Analyst

- “Crude Oil Price Outlook: Slope Broken, Confluent Support Under Siege” by Paul Robinson, Market Analyst

- “Market Sentiment Improves on Supportive News from China and Turkey”by Martin Essex, MSTA, Analyst and Editor

- “Crude Oil Price Analysis: Negative Momentum Builds After Key Technical Breach” by Justin McQueen, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX