Trading the News: Australia Employment Change

A 16.0K expansion in Australia Employment mayoffer little relief to the recent decline in AUDUSD as the Reserve Bank of Australia (RBA) appears to be on track to implement lower interest rates.

It remains to be seen if the fresh updates will influence the monetary policy outlook as the Unemployment Rate is expected to narrow to 5.1% from 5.2% in March, and signs of a robust labor market may push the RBA to revert back to a wait-and-see approach as “the Australian economy is still expected to strengthen later this year.”

In turn, a print of 16.0K or greater paired with a downtick in the jobless rate may spark a bullish reaction in the Australian dollar as it encourages the RBA to keep the official cash rate (OCR) on hold at the next meeting on July 2.

However, another batch of mixed data prints may fuel the recent decline in AUDUSD as it puts pressure on the RBA to further insulate the economy, and Governor Philip Lowe and Co. may prepare Australian households and businesses for lower interest rates as the “latest set of forecasts were prepared on the assumption that the cash rate would follow the path implied by market pricing, which was for the cash rate to be around 1 per cent by the end of the year.”

Sign up and join DailyFX Analyst David Cottle LIVE to cover the fresh updates to Australia’s Employment report.

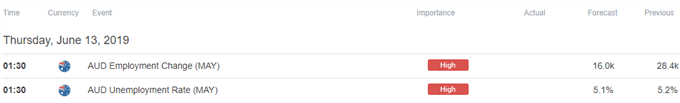

Impact that the Australia Employment report had on AUD/USD during the last print

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

APR 2019 | 05/16/2019 01:30:00 GMT | 15.0K | 28.4K | -5 | -32 |

April 2019Australia Employment Change

AUD/USD 5-Minute Chart

Australia Employment increased 28.4K in April after expanding a revised 27.7K the month prior, with the gain led by a 34.7K rise in part-time jobs, while full-time positions narrowed 6.3K during the same period. A deeper look at the report showed the Unemployment Rate unexpectedly widened to 5.2% from a revised 5.1% in March as the Participation Rate climbed to 65.8% from 65.7%, with the data suggesting discouraged workers are returning to the labor force.

The Australian dollar struggled to hold its ground following the batch of mixed data prints, with AUDUSD slipping below the 0.6900 handle to close the day at 0.6891. Learn more with the DailyFX Advanced Guide for Trading the News.

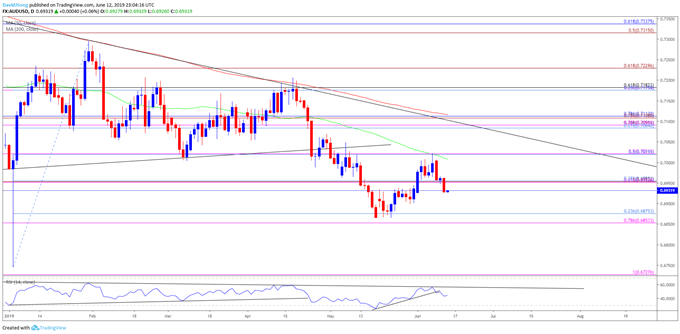

AUD/USD Rate Daily Chart

- Keep in mind, the AUDUSD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.7118), with the exchange rate marking another failed attempt to break/close above the moving average in April.

- In turn, AUDUSD remains at risk of giving back the rebound from the 2019-low (0.6745) as the wedge/triangle formation in both price and the Relative Strength Index (RSI) unravels.

- Downside targets coming back on the radar for AUDUSD as the recent advance fails to spur a run at the May-high (0.7061), with the near-term outlook capped by the 0.7020 (50% expansion) region.

- The break/close below the 0.6950 (61.8% expansion) pivot opens up the Fibonacci overlap around 0.6850 (78.6% expansion) to 0.6880 (23.6% retracement) as AUDUSD carves a series of lower highs and lows, with the next region of interest coming in around 0.6730 (100% expansion).

- Will keep a close eye on the RSI as it flashes a bearish signal, with the oscillator finally snapping the upward trend carried over from the previous month.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.