Trading the News: Reserve Bank of Australia (RBA) Interest Rate Decision

The Reserve Bank of Australia (RBA) interest rate decision may drag on the AUD/USD exchange rate as the central bank is widely anticipated to keep the official cash rate (OCR) at the record-low of 1.50% in April.

It seems as though the RBA will continue to endorse a wait-and-see approach monetary policy as the central bank sees ‘scenarios where an increase in the cash rate would be appropriate at some point and other scenarios where a decrease in the cash rate would be appropriate.’ Mixed language coming out of the RBA is likely to weigh on the Australian dollar as the central bank looks to further support the economy, and Governor Philip Lowe & Co. may continue to tame bets for higher interest rates as officials note ‘that there was not a strong case for a near-term adjustment in monetary policy.’

However, an unexpected batch of hawkish rhetoric may trigger a bullish reaction in AUD/USD as it spurs bets for an RBA rate-hike, and a upcoming change in regime may heighten the appeal of the Australian dollar as market participants prepare for higher interest rates. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Impact that the RBA rate decision has had on AUD/USD during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

MAR 2019 | 03/05/2018 03:30:00 GMT | 1.50% | 1.50% | -2 | +6 |

March 2019Reserve Bank of Australia (RBA) Interest Rate Decision

AUD/USD 5-Minute Chart

As expected, the Reserve Bank of Australia (RBA) kept the official cash rate (OCR) at the record-low of 1.50% in March, with the central bank warning that the ‘slower pace of growth has continued into 2019’ as Governor Philip Lowe & Co. appear to be in no rush to alter the outlook for monetary policy. The RBA went onto say that ‘other indicators suggest growth in the Australian economy slowed over the second half of 2018,’ and it seems as though the central bank is in no rush to alter the monetary policy outlook as ‘the low level of interest rates is continuing to support the Australian economy.’

Nevertheless, the mixed rhetoric coming out of the RBA sparked a choppy reaction in the Australian dollar, with AUD/USD largely consolidating throughout the day to close at 0.7084. Learn more with the DailyFX Advanced Guide for Trading the News.

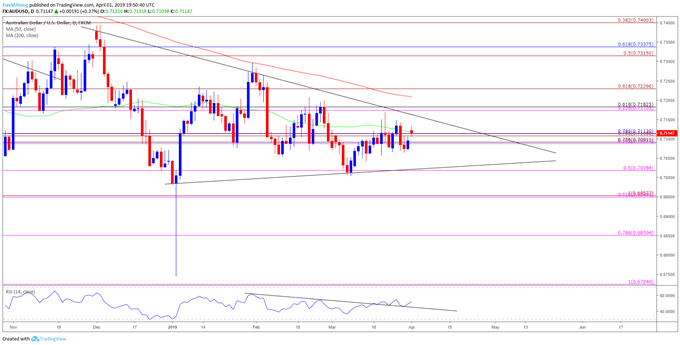

AUD/USD Rate Daily Chart

- Keep in mind, the AUD/USD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.7208), with the exchange rate still tracking the bearish trend from late-2018 as the rebound from the March-low (0.7003) fails to push aussie-dollar back above the Fibonacci overlap around 0.7170 (23.6% expansion) to 0.7180 (61.8% retracement).

- However, the Relative Strength Index (RSI) offers a mixed signal as the oscillator breaks out of the bearish formation from earlier this year, and AUD/USD may fail to fill the gap from earlier this week as it trades back above the 0.7090 (78.6% retracement) to 0.7110 (78.6% retracement) pivot.

- Will keep a close eye on trendline resistance as AUD/USD appears to be making another run at the 0.7170 (23.6% expansion) to 0.7180 (61.8% retracement) region, with a break of the bearish formation raising the risk for a move towards 0.7230 (61.8% expansion).

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.