Trading the News: Australia Employment Change

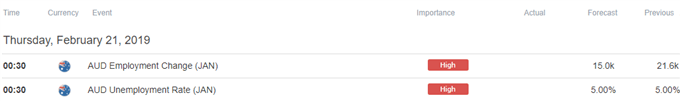

Updates to Australia’s Employment report may curb the AUD/USD pullback following the Federal Open Market Committee (FOMC) Minutes as the economy is expected to add another 15.0K jobs in January.

Signs of a more robust labor market may heighten the appeal of the Australian dollar as it boosts the outlook for growth and inflation, and the Reserve Bank of Australia (RBA) may have a difficult time defending the wait-and-see approach for monetary policy as ‘growth was expected to be a little above trend over the forecast period.’

In turn, a headline print of 15.0K or great may spark a bullish reaction in AUD/USD as it puts pressure on the RBA to lift the official cash rate (OCR) off of the record-low, but a dismal development may curb the recent appreciation in the Australian dollar as Governor Philip Lowe & Co. warn that there are‘significant uncertainties around the forecasts, with scenarios where an increase in the cash rate would be appropriate at some point and other scenarios where a decrease in the cash rate would be appropriate.’ Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Impact that Australia Employment report had on AUD/USD during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

DEC 2018 | 01/24/2019 00:30:00 GMT | 18.0K | 21.6K | +18 | -53 |

December 2018 Australia Employment Change

AUD/USD 5-Minute Chart

Fresh figures coming out of Australia showed the economy adding 21.6K jobs in December following a 39.0K expansion the month prior, while the Unemployment Rate unexpectedly narrowed to 5.0% from 5.1% during the same period as the Participation Rate slipped to 65.6% from 65.7% in November. A deeper look at the report showed part-time employment increasing 24.6K in December to lead the advance, while full-time positions slipped another 3.0K following a 7.3K contraction the month prior.

The Australian dollar nudged higher following the better-than-expected print, but the reaction was short-lived, with the aussie-dollar exchange rate slipping back below the 0.7100 handle to close the day at 0.7090. Learn more with the DailyFX Advanced Guide for Trading the News.

AUD/USD Daily Chart

- Keep in mind, the broader outlook for AUD/USD remains tilted to the downside as the flash-crash rebound stalls at the 200-Day SMA (0.7276), with both price and the Relative Strength Index (RSI) failing to preserve the bullish formations from earlier this year.

- However, it seems as though AUD/USD will continue to hold above the psychologically important 0.7000 handle as it reverses course ahead of the 0.7020 (50% expansion) hurdle, with advance from the monthly-low (0.7054) bring the 0.7170 (23.6% expansion) to 0.7180 (61.8% retracement) region back on the radar.

- Need a break/close above the Fibonacci overlap to open up the 0.7230 (61.8% expansion) area, with the next region of interest coming in around 0.7320 (50% expansion) to 0.7340 (61.8% retracement).

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.