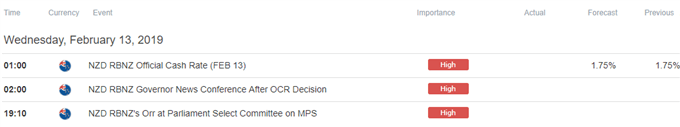

Trading the News: Reserve Bank of New Zealand (RBNZ) Interest Rate Decision

The Reserve Bank of New Zealand’s (RBNZ) first meeting for 2019 may do little to curb the recent weakness in NZD/USD as the central bank is widely expected to keep the official cash rate (OCR) at the record-low of 1.75%.

Like the Reserve Bank of Australia (RBA), the RBNZ may show a greater willingness to further support the economy amid the weakening outlook for the Asia/Pacific region, and the central bank may continue to tame bets for higher interest rates as ‘business surveys continue to suggest growth will be soft in the near term..’

As a result, dovish comments from Governor Adrian Orris likely to produce a bearish reaction in NZD/USD, but a sudden shift in the forward-guidance may heighten the appeal of the New Zealand dollar as market participants boost bets for an imminent RBNZ rate-hike. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Impact that the RBNZ rate decision has had on NZD/USD during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

NOV 2018 | 11/07/2018 20:00:00 GMT | 1.75% | 1.75% | -7 | -36 |

November 2018 Reserve Bank of New Zealand (RBNZ) Interest Rate Decision

NZD/USD 15-Minute Chart

The Reserve Bank of New Zealand (RBNZ) stuck to the sidelines at its last meeting for 2018, with the central bank keeping the official cash rate (OCR) at the record-low of 1.75%. The fresh remarks suggest the RBNZ will continue to endorse a wait-and-see approach in 2019 as Governor Orr & Co. pledges to ‘keep the OCR at an expansionary level for a considerable period.’

The initial spike in NZD/USD was short-lived, with the New Zealand dollar grinding lower throughout the day to close at 0.6754. Learn more with the DailyFX Advanced Guide for Trading the News.

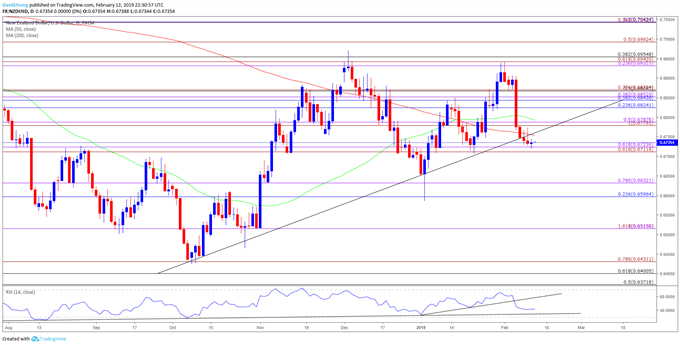

NZD/USD Daily Chart

- The advance from the 2019-low (0.6586) appears to be unraveling following failed attempt to break/close above the 0.6930 (23.6% expansion) to 0.6960 (38.2% retracement) region as both price and the Relative Strength Index (RSI) threaten the bullish formations carried over from the previous year.

- Need a break/close below the 0.6710 (61.8% expansion) to 0.6720 (61.8% expansion) area to open up the Fibonacci overlap around 0.6600 (23.6% retracement) to 0.6630 (78.6% expansion), with the next downside region of interest coming in around 0.6520 (100% expansion).

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.