Trading the News: New Zealand Employment Change

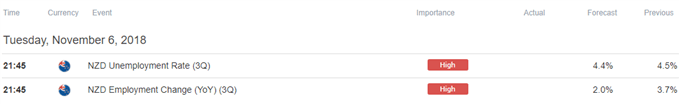

Updates to New Zealand’s Employment report may undermine the recent recovery in NZD/USD as job growth is expected to increase 2.0% after expanding 3.7% per annum in the second-quarter of 2018.

Signs of slowing employment is likely to keep the Reserve Bank of New Zealand (RBNZ) on the sidelines as ‘downside risks to the growth outlook remain,’ and the central bank may carry the record-low cash rate into 2019 as ‘consumer price inflation is expected to gradually rise to our 2 percent annual target as capacity pressures bite.’

In turn, another set of mixed data prints may spark a bearish reaction in the New Zealand dollar, but a positive development fuel the rebound in NZD/USD as it puts pressure on Governor Adrian Orr & Co. to lift the official cash rate (OCR) off of the record-low. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Impact that New Zealand Employment has had on NZD/USD during the last quarter

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

2Q 2018 | 07/31/2018 22:45:00 GMT | 3.6% | 3.7% | -17 | -28 |

2Q 2018 New Zealand Employment Change

NZD/USD 15-Minute Chart

New Zealand employment increased 3.7% after growing 3.1% per annum during the first three-months of 2018, while the jobless rate unexpectedly widened to 4.5% from 4.4% during the same period. A deeper look at the report showed the participation rate also expanding to 70.9% from 70.8% as discouraged worked returned to the labor force, while Average Hourly Earnings climbed a marginal 0.2% versus projections for a 1.0% rise.

The New Zealand dollar struggled to hold its ground following the mixed data prints, with NZD/USD slipping below the 0.6800 handle to close the day at 0.6791. Learn more with the DailyFX Advanced Guide for Trading the News.

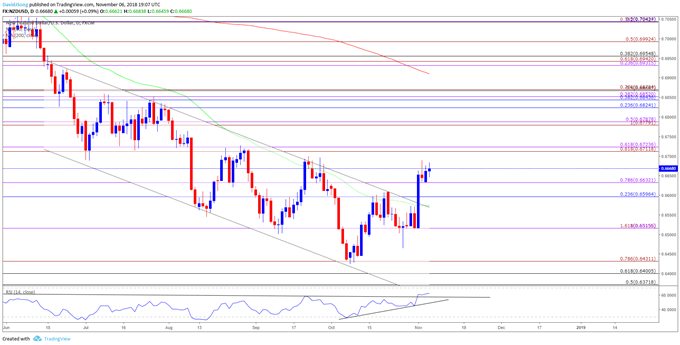

NZD/USD Daily Chart

- Recent price action in NZD/USD raises the risk for a larger correction as both price and the Relative Strength Index (RSI) break out of the bearish formations from earlier this year, with a move above the 0.6710 (61.8% expansion) to 0.6720 (61.8% expansion) raising the risk for a move back towards 0.6780 (100% expansion) to 0.6790 (50% expansion).

- However, lack of momentum to clear the September-high (0.6699) may generate range-bound prices in NZD/USD, with a move below the 0.6600 (23.6% retracement) to 0.6630 (78.6% expansion) opening up the 0.6520 (50% expansion) hurdle, which largely lines up with the monthly-low (0.6514).

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.