Trading the News: New Zealand Retail Sales ex Inflation

Updates to New Zealand’s Retail Sales report may fuel the recent recovery in NZD/USD as household spending is expected to increase 0.3% versus the 0.1% during the first three-months of 2018.

Signs of stronger consumption may heighten the appeal of the New Zealand dollar as it instills an improved outlook for growth and inflation, and the Reserve Bank of New Zealand (RBNZ) may start to drop its cautious tone over the coming months as ‘employment is roughly around its maximum sustainable level.’

However, another lackluster development may rattle the rebound in NZD/USD as it encourages the RBNZ to keep the official cash rate (OCR) at the record-low, and Governor Adrian Orr & Co. may stick to the current script at the next meeting on September 27 as officials warn that ‘the recent moderation in growth could last longer.’ Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Impact that the New Zealand Retail Sales has had on NZD/USD during the last print

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

1Q 2018 | 05/20/2018 22:45:00 GMT | 1.0% | 0.1% | -8 |

1Q 2018New Zealand Retail Sales ex. Inflation

NZD/USD 15-Minute Chart

Household spending in New Zealand increased 0.1% during the first three-months of 2018, with the previous reading revised down to reflect a 1.4% expansion versus an initial reading of 1.7%. A deeper look at the report showed demand for electrical goods increasing 5.4%, with sales of furniture/housewares climbing 2.4%, while discretionary spending on clothing/footwear narrowed 5.0% during the same period.

The New Zealand dollar struggled to hold its ground following the below-forecast print, with NZD/USD dipping below the 0.6900 handle, but the reaction was short-lived as the exchange rate closed the day at 0.6945. Learn more with the DailyFX Advanced Guide for Trading the News.

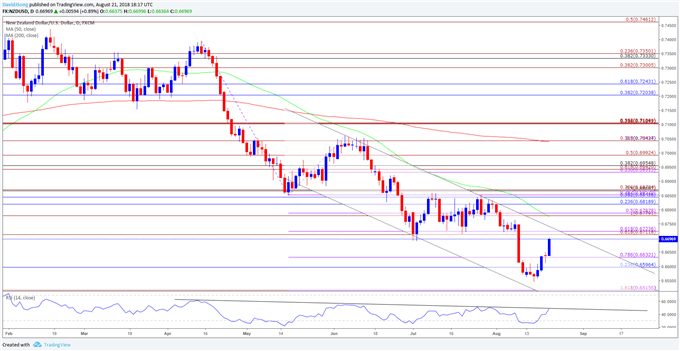

NZD/USD Daily Chart

- Broader outlook for NZD/USD remains tilted to the downside following the last RBNZ meeting as both price and the Relative Strength Index (RSI) extend the bearish formations from earlier this year.

- The rebound from the 2018-low (0.6544) is coming up against a key juncture as it approaches the former-support zone around 0.6710 (61.8% expansion) to 0.6720 (61.8% expansion), with a break above the stated region highlight a potential change in NZD/USD behavior.

- Next topside region of interest comes in around 0.6780 (100% expansion) to 0.6790 (50% expansion) followed by the 0.6820 (23.6% retracement) to 0.6870 (78.6% expansion).

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.