Trading the News: Federal Open Market Committee (FOMC) Interest Rate Decision

The Federal Reserve interest rate decision may spark a limited reaction as the central bank is widely expected to keep the benchmark rate on hold, but a shift in the forward-guidance for monetary policy may alter the near-term outlook for EUR/USD as Fed officials stick to the hiking-cycle.

Fresh comments from Fed officials may heighten the appeal of the U.S. dollar as the central bank appears to be on track to further normalize monetary policy, and Chairman Jerome Powell & Co. may ultimately prepare U.S. households and businesses for an imminent rate-hike as ‘the FOMC believes that--for now--the best way forward is to keep gradually raising the federal funds rate.’

As a result, a batch of hawkish Fed rhetoric may weigh on EUR/USD, but more of the same from the central bank may produce headwinds for the U.S. dollar as it dampens bets for four Fed rate-hikes in 2018.Sign up and join DailyFX Chief Strategist John Kicklighter LIVE to cover the FOMC interest rate decision.

Impact that the Fed rate decision has had on EUR/USD during the previous meeting

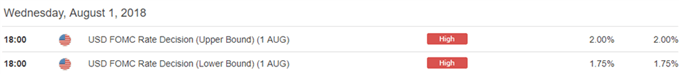

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JUN 2018 | 06/13/2018 18:00:00 GMT | 1.75% to 2.00% | 1.75% to 2.00% | +1 | +5 |

June 2018 Federal Open Market Committee (FOMC) Interest Rate Decision

EUR/USD 5-Minute Chart

As expected, the Federal Open Market Committee (FOMC) delivered a 25bp rate-hike at the quarterly meeting in June, with the central bank increasing the benchmark interest to a fresh target range of 1.75% to 2.00% as ‘recent data suggest that growth of household spending has picked up, while business fixed investment has continued to grow strongly.’ The fresh comments suggest the Fed will continue to alter the forward-guidance while normalize monetary policy in 2018 as the ‘Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term.’

The initial decline in EUR/USD was short-lived, with the exchange rate bouncing back from a low of 1.1725 to close the day at 1.1791. Review the DailyFX Advanced Guide for Trading the News to learn our 8 step strategy.

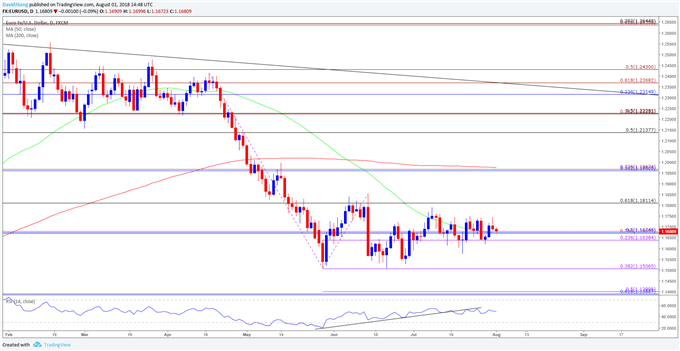

EUR/USD Daily Chart

- The string of failed attempts to test the July-high (1.1791) may push EUR/USD back towards the lower bounds of its recent range, with the 1.1510 (38.2% expansion) region on the radar as it largely lines up with the June-low (1.1508).

- Need a break/close below the stated region to open up the downside targets for EUR/USD, with the first region of interest coming in around 1.1390 (61.8% retracement) to 1.1400 (50% expansion) followed by the 1.1290 (61.8% expansion) hurdle.

For more in-depth analysis, check out the Q3 Forecast for EUR/USD

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.