Trading the News: U.S. Consumer Price Index (CPI)

Updates to the U.S. Consumer Price Index (CPI) may generate a larger pullback in EUR/USD as the headline and core reading for inflation are expected to pick up in June.

Signs of heightening price pressures may boost the appeal of the greenback as it puts pressure on the Federal Open Market Committee (FOMC) to further normalize monetary policy over the coming months, and the central bank may show a greater willingness to implement four rate-hikes in 2018 as Chairman Jerome Powell and Co. ‘generally judged that, with the economy already very strong and inflation expected to run at 2 percent on a sustained basis over the medium term, it would likely be appropriate to continue gradually raising the target range for the federal funds rate to a setting that was at or somewhat above their estimates of its longer-run level by 2019 or 2020.’

As a result, the FOMC may continue to prepare U.S. households and businesses for higher borrowing-costs at the next meeting on August 1, but a lackluster development may spark a bearish reaction in the greenback as it dampens the central bank’s scope to extend the hiking-cycle.

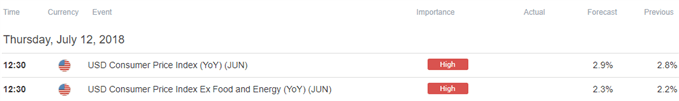

Impact that the U.S. CPI report has had on EUR/USD during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

MAY 2018 | 06/12/2018 12:30:00 GMT | 2.8% | 2.8% | +15 | -34 |

May 2018 U.S. Consumer Price Index (CPI)

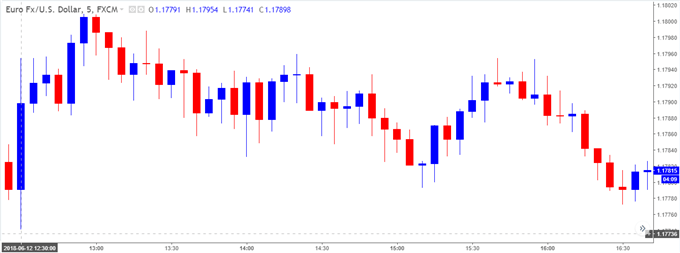

The U.S. Consumer Price Index (CPI) was largely in-line with market expectations as the headline reading increased 2.8% per annum in May, while the core rate highlighting a similar dynamic as the reading climbed to 2.2% from 2.1% in April. However, a deeper look at the report showed Real Average Hourly Earnings were flat in May after expanding 0.2% the month prior, while Real Average Weekly Earnings narrowing to 0.3% from a revised 0.5% during the same period.

The initial reaction to mixed data prints were short-lived, with EUR/USD consolidating throughout the North American trade to end the day at 1.1745. Sign up and join DailyFX Currency Analyst David Song LIVE to cover the fresh updates to the CPI report.

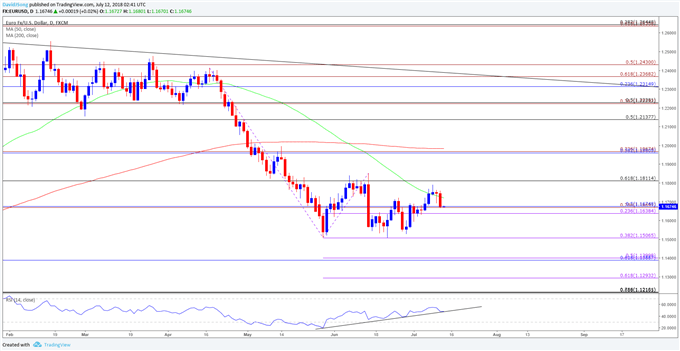

EUR/USD Daily Chart

- EUR/USD stands at risk of facing range-bound prices as it snaps the recent series of higher highs & lows following the failed attempt to test the June-high (1.1852).

- Lack of momentum to test the 1.1810 (61.8% retracement) region may pave the way for a larger pullback, with a break/close below the 1.1640 (23.6% expansion) to 1.1680 (50% retracement) region bringing the June-low (1.1508) on the radar, which lines up with the 1.1510 (38.2% expansion) hurdle.

For more in-depth analysis, check out the Q3 Forecast for EUR/USD

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.