Trading the News: U.S. Non-Farm Payrolls (NFP)

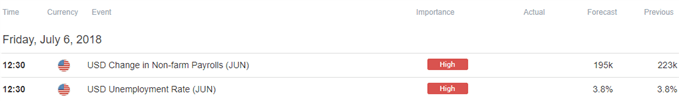

Updates to the U.S. Non-Farm Payrolls (NFP) report may tame the recent rebound in EUR/USD as the world’s largest economy is anticipated to add another 195K jobs in June.

Moreover, Average Hourly Earnings are expected to uptick to an annualized 2.8% from 2.7% in May, and signs of stronger job/wage growth should keep the Federal Open Market Committee (FOMC) on course to implement four rate-hikes in 2018 as the central bank largely achieves its dual mandate for full-employment and price stability.

In turn, the FOMC may largely reiterate that ‘gradually returning interest rates to a more normal level as the economy strengthens is the best way the Fed can help sustain an environment in which American households and businesses can thrive,’ and Chairman Jerome Powell & Co. may show a greater willingness to adopt a more aggressive approach in normalizing monetary policy as ‘economic growth appears to have picked up in the current

quarter, largely reflecting a bounceback in household spending.’

However, a batch of lackluster data prints may fuel a larger recovery in EUR/USD as it encourages FOMC officials to retain their current projections for a neutral Fed Funds rate of 2.75% to 3.00%, with the greenback at risk of exhibiting a more bearish behavior over the near-term as it dampens the outlook for growth and inflation.

Impact that the U.S. NFP report has had on EUR/USD during the previous print

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

APR 2018 | 06/01/2018 12:30:00 GMT | 190K | 223K | +8 | -14 |

April 2018 U.S. Non-Farm Payrolls (NFP)

EUR/USD 10-Minute Chart

The U.S. economy added 223K jobs in May following a 159K expansion the month prior, while the Unemployment Rate unexpectedly narrowed to an annualized 3.8% from 3.9% in April as the Labor Force Participation Rate slipped to 62.7% from 62.8% during the same period. At the same time, Average Hourly Earnings increased 2.7% per annum amid forecasts for a 2.6% print, with the gauge for Average Weekly Hours holding steady at 34.5.

The initial downtick in EUR/USD was short-lived, with the pair largely consolidating throughout the day to close at 1.1657. Sign up and join DailyFX Strategists Michael Boutros and Christopher Vecchio LIVE to cover the fresh updates to the NFP report.

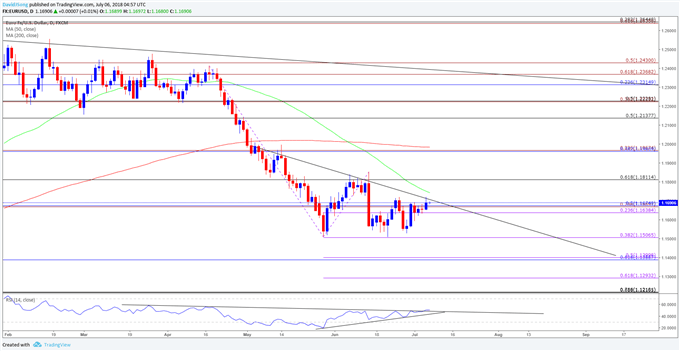

EUR/USD Daily Chart

- Keeping a close eye on the Relative Strength Index (RSI) as it threatens the bearish formation from earlier this year, but need to see EUR/USD also break trendline resistance for a more meaningful run at the June-high (1.1852).

- Need a close above the 1.1810 (61.8% retracement) hurdle to open up the topside targets, with the first region of interest coming in around 1.1970 (23.6% expansion) followed by the 1.2140 (50% retracement) area.

- However, failure to hold above the 1.1640 (23.6% expansion) to 1.1680 (50% retracement) region bring the June-low (1.1508) on the radar, with a break/close below the 1.1510 (38.2% expansion) region opening up the Fibonacci overlap around 1.1390 (61.8% retracement) to 1.1400 (50% expansion).

For more in-depth analysis, check out the Q3 Forecast for EUR/USD

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.