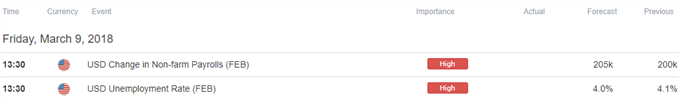

- U.S. Non-Farm Payrolls (NFP) to Increase 205K in February, Unemployment Rate to Narrow to Annualized 4.0% from 4.1%.

- Average Hourly Earnings to Slow to 2.8% per Annum from 2.9% in January. Will Chairman Jerome Powell and Co. Continue to Project a Neutral Fed Funds Rate of 2.75% to 3.00%?

Trading the News: U.S. Non-Farm Payrolls (NFP)

Updates to the U.S. Non-Farm Payrolls (NFP) report may curb the recent decline in EUR/USD should the data prints dampen bets for four Fed rate-hikes in 2018.

Even though the economy is expected to add 205K jobs in February, a slowdown in Average Hourly Earnings may limit the Federal Open Market Committee’s (FOMC) scope to implement a more aggressive hiking-cycle as the central bank struggles to achieve the 2% target for inflation. Keep in mind, the data may do little to deter the FOMC from raising the benchmark interest rate in March as ‘the Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate,’ but a batch of lackluster developments may push Chairman Jerome Powell and Co. to implement a dovish rate-hike as ‘some participants saw an appreciable risk that inflation would continue to fall short of the Committee's objective.

At the same time, a series of positive developments may keep EUR/USD under pressure, with the pair at risk of facing a larger correction as the European Central Bank (ECB) refuses to deliver a detailed exit-strategy.

Impact that the U.S. NFP report has had on EUR/USD during the previous print

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JAN 2018 | 02/02/2018 13:30:00 GMT | 180K | 200K | -35 | -36 |

January 2018 U.S. Non-Farm Payrolls (NFP)

EUR/USD 5-Minute Chart

The U.S. Non-Farm Payrolls (NFP) increased 200K in January after expanding a revised 160K the month prior, while the jobless rate held steady at an annualized 4.1% for the fourth consecutive month. A deeper look at the report showed the Labor Force Participation rate was also unchanged at 62.7%, while Average Hourly Earnings increased 2.9% per annum amid projections for a 2.6% print.

The U.S. dollar gained ground following the batch of better-than-expected prints, with EUR/USD pulling back from the 1.2500 region to end the day at 1.2455. Want More insight? Join the DailyFX Team Live to cover the NFP report.

EUR/USD Daily Chart

- EUR/USD may face a more meaningful correction as it pulls back ahead of the 2018-high (1.2556), with the pair at risk for further losses as it snaps the series of higher highs & lows from the previous week.

- Keeping a close eye on the Relative Strength Index (RSI) as it comes off of trendline resistance and extends the bearish formation from earlier this year.

- May see EUR/USD continue to pullback from the 1.2430 (50% expansion) region, with a break/close below 1.2230 (50% retracement) raising the risk for a move back towards 1.2130 (50% retracement), which sits just beneath the March-low (1.2155); next downside hurdle comes in around 1.1960 (38.2% retracement) to 1.1970 (23.6% expansion).

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link