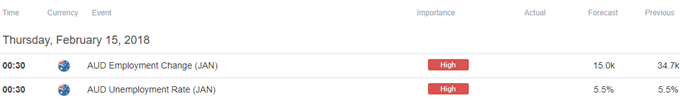

- Australia Employment to Increase 15.0K in January.

- Jobless Rate to Hold Steady at Annualized 5.5%.

Trading the News: Australia Employment Change

A 15.0K expansion in Australia Employment may generate a limited reaction as it does little to alter the outlook for monetary policy, but another above-forecast print may spark a bullish reaction in AUD/USD as it instills an improved outlook for growth and inflation.

Even though the Reserve Bank of Australia (RBA) remains in no rush to lift the cash rate off of the record-low, Governor Philip Lowe & Co. may gradually change their tune over the coming months as ‘various forward-looking indicators continue to point to solid growth in employment over the period ahead.’ Evidence of diminishing labor market slack may put pressure on the RBA to scrap its wait-and-see approach, and the RBA may start to prepare Australian households and businesses for higher borrowing-costs as the central bank head warns ‘it is more likely that the next move in interest rates will be up, rather than down.’

Nevertheless, a set of lackluster data prints may rattle the recent advance in AUD/USD, and the pair may struggle to hold its ground ahead of President Lowe’s testimony before the House of Representatives' Standing Committee on Economics should the report sap bets for an imminent rate-hike. Interested in watching the market reaction? Sign up & join DailyFX Currency Strategist Ilya Spivak LIVE to cover Australia’s employment report.

Impact that Australia Employment has had on AUD/USD during the previous print

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

DEC 2017 | 01/18/2018 00:30:00 GMT | 15.0K | 34.7K | -15 | +29 |

December 2017 Australia Employment Change

AUD/USD 5-Minute Chart

Australia Employment increased 34.7K in December after climbing a revised 63.6K the month prior, while the jobless-rate unexpected widened to an annualized 5.5% from 5.4% as the labor force participation rate increased to 65.7% from 65.5% in November. A deeper look at the report showed the rise in job growth was led by a 19.5K expansion in part-time positions, while full-time employment rose 15.1K during the same period.

The initial market reaction was short-lived, with AUD/USD slipping below the 0.7950 region, but the Australian dollar regained its footing throughout the day to close at 0.7998. New to trading? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

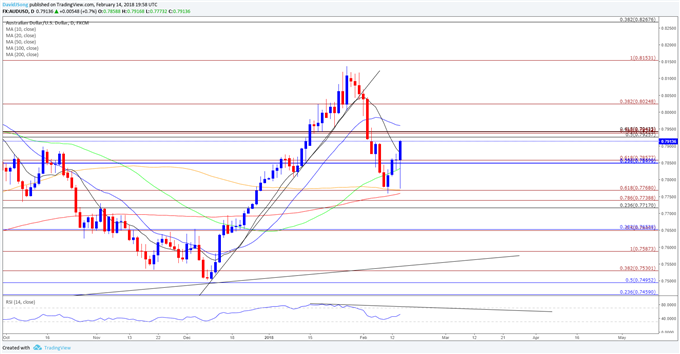

AUD/USD Daily Chart

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

- Keep in mind, the broader outlook remains clouded with mixed signals as AUD/USD snaps the upward trend from late-2017, while the Relative Strength Index (RSI) extends the bearish formation from earlier this year.

- Nevertheless, AUD/USD may stage a larger rebound as it carves a fresh series of higher highs following the failed attempt to break below the former-resistance zone around 0.7720 (23.6% retracement) to 0.7770 (61.8% expansion), while the RSI bounces back ahead of oversold territory.

- Break/close above the 0.7930 (50% retracement) to 0.7940 (61.8% retracement) region raises the risk for a move back towards 0.8030 (38.2% expansion), with the next region of interest coming in around 0.8150 (100% expansion), which sits just above the 2018-high (0.8136).

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.