- Reserve Bank of Australia (RBA) to Keep Cash Rate at Record-Low.

- Will Governor Philip Lowe & Co. Continue to Endorse a Wait-and-See Approach?

Trading the News: Reserve Bank of Australia (RBA) Interest Rate Decision

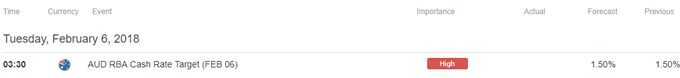

The Reserve Bank of Australia’s (RBA) first interest rate decision for 2018 may fuel the recent series of lower highs & lows in AUD/USD should the central bank continue to endorse a wait-and-see approach for monetary policy.

The below-forecast print for Australia’s Consumer Price Index (CPI) may keep the RBA on the sidelines as ‘wage growth remains low,’ and the board may merely attempt to buy more time as ‘the outlook for household consumption continued to be a significant risk, given that household incomes were growing slowly and debt levels were high.’ In turn, the Australian dollar may face a bearish reaction if the RBA continues to tame expectations for a rate-hike, but the central bank may start to alter the monetary policy outlook as Governor Philip Lowewarns that ‘it is more likely that the next move in interest rates will be up, rather than down.’

As a result, an unexpected batch of hawkish rhetoric may curb the recent selloff in AUD/USD as market participants boost bets for higher borrowing-costs. Interested in watching the market reaction? Sign up & join DailyFX Market Analyst David Cottle LIVE to cover the RBA rate decision.

Impact that RBA interest rate decision has had on AUD/USD during the previous meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

DEC 2017 | 10/05/2017 03:30:00 GMT | 1.50% | 1.50% | +12 | -28 |

DEC 2017 Reserve Bank of Australia (RBA) Interest Rate Decision

AUD/USD 10-Minute Chart

The Reserve Bank of Australia (RBA) kept the official cash rate at the record-low of 1.50% in December, with the central bank still jawboning the local currency as ‘an appreciating exchange rate would be expected to result in a slower pick-up in economic activity and inflation than currently forecast.’ The remarks suggest the RBA remains in no rush to normalize monetary policy as ‘inflation remains low, with both CPI and underlying inflation running a little below 2 per cent,’ and it seems as though the central bank will stick to the sidelines for the foreseeable future as ‘growth in housing debt has been outpacing the slow growth in household income for some time.’

More of the same from the RBA generated a limited reaction, with AUD/USD consolidating throughout the day to close at 0.7795. New to trading? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

AUD/USD Daily Chart

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

- Downside targets are on the radar following the failed attempt to test the 0.8150 (100% expansion) region, with AUD/USD at risk of extending the recent series of lower highs & lows as both price and the Relative Strength Index (RSI) snap the bullish formations carried over from late-2017.

- AUD/USD is quickly coming up against the 0.7850 (38.2% retracement) to 0.7860 (61.8% expansion) region, with the next downside hurdle coming in around 0.7720 (23.6% retracement) to 0.7770 (61.8% expansion).

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.