- Bank of Canada (BoC) to Keep Benchmark Interest Rate at 1.00%.

- Will Governor Poloz & Co. Warn of Higher Borrowing-Costs?

Trading the News: Bank of Canada (BoC) Interest Rate Decision

The Bank of Canada’s (BoC) last meeting for 2017 may spark a limited reaction as the central bank is expected to keep the benchmark interest rate at 1.00%, but the accompanying statement may fuel the near-term decline in USD/CAD should Governor Stephen Poloz and Co. show a greater willingness to further normalize monetary policy in 2018.

The BoC may attempt to buy more time and tame expectations for an imminent rate-hike as ‘growth is expected to moderate to a more sustainable pace in the second half of 2017 and remain close to potential over the next two years,’ but the central bank may have little choice but to prepare Canadian households and businesses for higher borrowing-costs as ‘less monetary policy stimulus will likely be required over time.’ In turn, a hawkish hold from the BoC may ultimately trigger a bullish reaction in the Canadian dollar as the central bank moves away from its easing-cycle.

Impact that the BoC rate decision has had on USD/CAD during the previous meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

OCT 2017 | 10/25/2017 14:00:00 GMT | 1.00% | 1.00% | +139 | +147 |

October 2017 Bank of Canada (BoC) Interest Rate Decision

USD/CAD 5-Minute Chart

As expected, the Bank of Canada (BoC) kept the benchmark interest rate at 1.00% in October after delivering two consecutive rate-hikes in the second-half of 2017, with the central bank largely endorsing a wait-and-see approach for monetary policy as ‘wage and other data indicate that there is still slack in the labour market.’ The cautious tone suggests Governor Stephen Poloz and Co. will carry the current policy into 2018, but the central bank appears to be on course to implement higher borrowing-costs over the coming months as ‘the Bank estimates that the economy is operating close to its potential.’

The Canadian dollar lost ground following the BoC rate decision, with USD/CAD climbing above the 1.2700 handle to end the day at 1.2796. Looking to the BoC meeting but don’t have a strategy? Download & review the DailyFX Advanced Guide for Trading the News to learn our 8 step strategy.

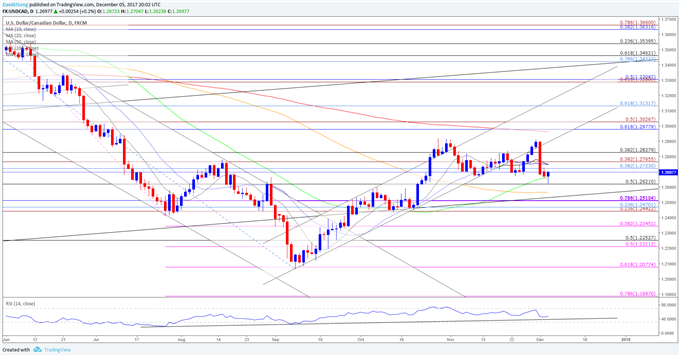

USD/CAD Daily Chart

- The advance from the September-low (1.2061) appears to be losing momentum as USD/CAD snaps the upward trend following the string of failed attempts to test the October-high (1.2917), with the Relative Strength Index (RSI) highlighting a similar behavior as it turns around ahead of overbought territory.

- May see the RSI flash a bearish trigger as it comes up against trendline support, with the near-term outlook capped by the former-support zone around1.2980 (61.8% retracement) to 1.3030 (50% expansion).

- Looking for a break/close below the 1.2620 (50% retracement) region to open up the Fibonacci overlap around 1.2440 (23.6% expansion) to 1.2510 (78.6% expansion) as the exchange rate starts to carve a series of lower highs & lows.

Want more insight? Sign up & join DailyFX Currency Analyst David Song LIVE to cover the BoC interest rate decision!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.