- Bank of Canada (BoC) to Keep Rates on Hold Following Two Consecutive Hikes.

- Will Governor Poloz & Co. Implement Higher Borrowing-Costs in 2018?

- Sign up & Join DailyFX Currency Analyst David Song LIVE to Cover the BoC Rate Decision.

Trading the News: Bank of Canada Interest Rate Decision

The Bank of Canada (BoC) interest rate decision may spark a limited market reaction as Governor Stephen Poloz and Co. are widely anticipated to keep the benchmark interest rate at 1.00%, but the accompanying policy statement may ultimately alter the near-term outlook for USD/CAD should the central bank tame expectations for higher borrowing-costs.

Recent comments from Governor Poloz suggests the BoC may adopt a more gradual path in normalizing monetary policy as ‘recent data point clearly to a moderation in the second half of the year,’ and the central bank may largely endorse a wait-and-see approach for 2018 as ‘the story of inflation in Canada over the past few years has been dominated by downside risks.’ In turn, the dollar-loonie exchange rate may stage a more meaningful correction off of the 2017-low (1.2061) especially as an inverse head-and-shoulders formation appears to be taking shape, but the broader shift in USD/CAD behavior may continue to unfold over the coming months as the BoC appears to be on course to implement higher borrowing-costs in the year ahead.

Impact that BoC rate decision has had on USD/CAD during the previous meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

SEP 2017 | 09/06/2017 14:00:00 GMT | 0.75% | 1.00% | -174 | -181 |

September 2017 Bank of Canada (BoC) Interest Rate Decision

USD/CAD 10-Minute Chart

The Bank of Canada (BoC) unexpected delivered another 25bp rate-hike in September, with the central bank lifting the benchmark interest rate to 1.00% from 0.75% as ‘recent economic data have been stronger than expected, supporting the Bank’s view that growth in Canada is becoming more broadly-based and self-sustaining.’ Nevertheless, Governor Stephen Poloz and Co. went onto say that ‘future monetary policy decisions are not predetermined and will be guided by incoming economic data and financial market developments’as price growth continues to run below the 2% target. The Canadian dollar staged a meaning rally following the rate-hike, with USD/CAD clearing the 1.2300 handle to end the day at 1.2225.

How To Trade This Event Risk(Video)

Bearish CAD Trade: Governor Poloz & Co. Endorse Wait-and-See Approach

- Need a green, five-minute candle following the rate decision to favor a short loonie trade.

- If market reaction favors a bearish loonie position, buy USD/CAD with two separate lots.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish CAD Trade: BoC Stays on Course to Implement More Rate-Hikes

- Need a red, five-minute USD/CAD candle to favor a long loonie position.

- Implement the same setup as the bearish loonie trade, just in reverse.

Potential Price Targets For The Release

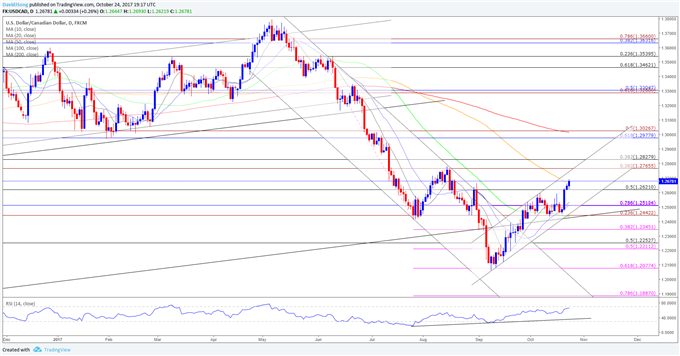

USD/CAD Daily Chart

Check out our USD/CAD quarterly projections in our FREE DailyFX Trading Forecasts

- Topside targets remains on the radar for USD/CAD it clears the monthly opening range and extends the series of higher highs & lows from the previous week, with the next region of interest coming in around 1.2770 (38.2% expansion) to 1.2830 (38.2% retracement), which largely lines up with the August-high (1.2778).

- Keeping a close eye on the Relative Strength Index (RSI) as it preserves the bullish formation carried over from the summer months and approaches overbought territory; break above 70 raises the risk for a further advance in the exchange rate as the bullish momentum gathers pace.

- Interim Resistance:1.2770 (38.2% expansion) to 1.2830 (38.2% retracement)

- Interim Support: 1.1890 (78.6% expansion) to 1.1920 (May 2015-low)

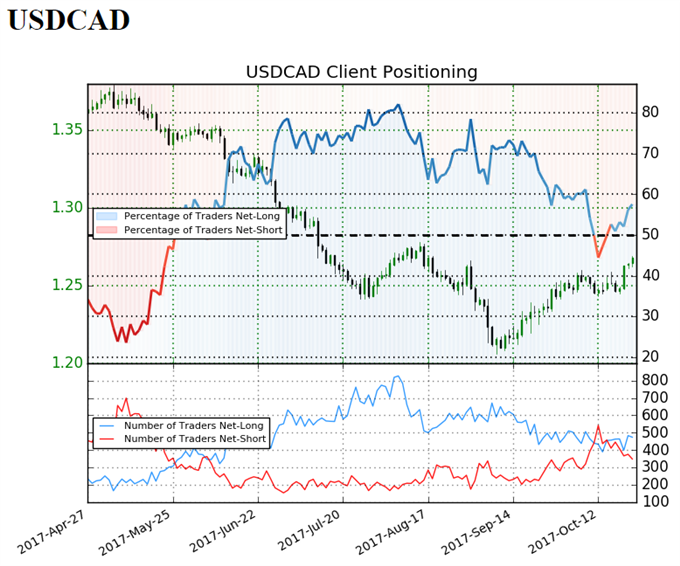

USD/CAD Retail Sentiment

Track Retail Sentiment in Real-Time with the New Gauge Developed by DailyFX

Retail trader data shows 57.6% of traders are net-long USD/CAD with the ratio of traders long to short at 1.36 to 1.

In fact, traders have remained net-long since October 16 when USD/CAD traded near 1.25145; price has moved 1.3% higher since then. The number of traders net-long is 4.6% lower than yesterday and 8.1% lower from last week, while the number of traders net-short is 8.9% lower than yesterday and 25.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.