- Canada Consumer Price Index (CPI) to Increase for Third Consecutive Month.

- Core Rate of Inflation Climbed Annualized 1.5% in August.

- Sign Up & Join DailyFX Currency Analyst David Song to Discuss Key FX Themes & Potential Trade Setups.

Trading the News: Canada Consumer Price Index (CPI)

Another 0.4% rise in Canada Retail Sales paired with marked pickup in the Consumer Price Index (CPI) may derail the near-term rebound in USD/CAD as it encourages the Bank of Canada (BoC) to further normalize monetary policy over the coming months.

After delivering two consecutive rate-hikes, recent comments from Governor Stephen Poloz and Co. suggests the central bank will carry the current policy into 2018 as the central bank head notes that ‘there is no predetermined path for interest rates.’ However, sign of heightening price pressures may force the BoC to adopt a more hawkish tone as ‘recent economic data have been stronger than expected,’ and the broader shift in USD/CAD behavior may continue to take shape over the coming months as the central bank appears to be on course to implement higher borrowing-costs in 2018.

Impact that Canada’s CPI report has had on USD/CAD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

AUG 2017 | 09/22/2017 12:30:00 GMT | 1.5% | 1.4% | +56 | +76 |

August 2017 Canada Consumer Price Index (CPI)

USD/CAD 5-Minute Chart

Canada’s Consumer Price Index (CPI) increased for the second consecutive month in August, with the headline reading climbing to an annualized 1.4% from 1.2% the month prior. Even though the pickup was largely drive by a higher gas and energy price, the core rate of inflation advanced to 1.5% per annum from 1.4% during the same period to mark the first rise since December. The Canadian dollar lost ground following the below-forecast prints, with USD/CAD climbing above the 1.2300 handle to end the day at 1.2329.

How To Trade This Event Risk(Video)

Bullish CAD Trade: CPI Report Exceeds Market Expectations

- Need a red, five-minute candle following the fresh prints to favor a short USD/CAD position.

- If market reaction favors a bullish loonie trade, sell USD/CAD with two separate lots.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish CAD Trade: Headline & Core Inflation Disappoints

- Need a green, five-minute USD/CAD candle to favor a short loonie position.

- Implement the same setup as the bullish loonie trade, just in the opposite direction.

Potential Price Targets For The Release

USD/CAD Daily Chart

Check out our USD/CAD quarterly projections in our FREE DailyFX Trading Forecasts

- USD/CAD may continue to consolidate as it holds within the monthly opening range, with the 1.2620 (50% retracement) region acting as resistance, while the 1.2440 (23.6% expansion) area offers support.

- Keeping a close eye on the Relative Strength Index (RSI) as it appears to be turning over ahead of overbought territory, with the next downside hurdle coming in around 1.2350 (38.2% expansion), but the near-term outlook remains constructive as the momentum indicator preserves the bullish formation carried over from the summer months.

- In turn, a break of the October-high (1.2598) may open up the next topside hurdle around 1.2770 (38.2% expansion) to 1.2830 (38.2% retracement), which largely lines up with the August-high (1.2778).

- Interim Resistance:1.2770 (38.2% expansion) to 1.2830 (38.2% retracement)

- Interim Support: 1.1890 (78.6% expansion) to 1.1920 (May 2015-low)

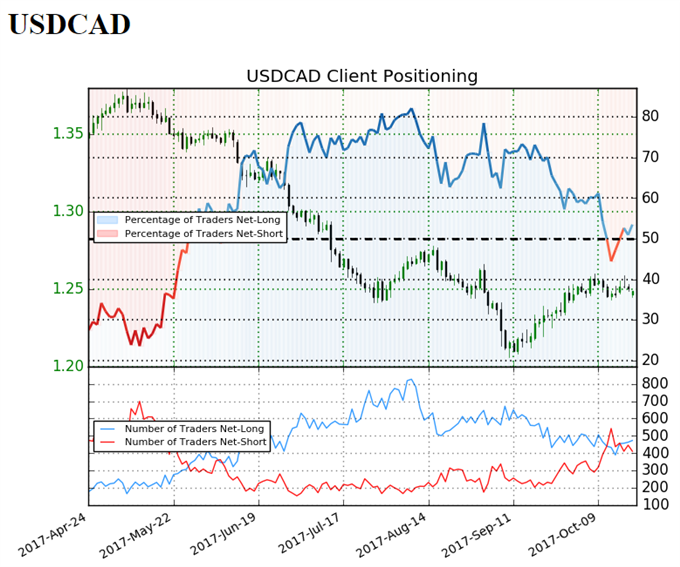

USD/CAD Retail Sentiment

Track Retail Sentiment in Real-Time with the New Gauge Developed by DailyFX

Retail trader data shows 53.5% of traders are net-long USD/CAD with the ratio of traders long to short at 1.15 to 1.

The number of traders net-long is 3.3% lower than yesterday and 3.0% higher from last week, while the number of traders net-short is 10.2% lower than yesterday and 16.6% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.