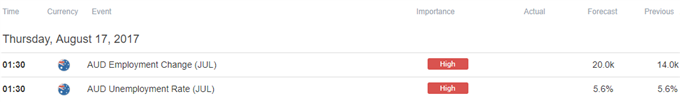

- Australia Employment to Increase for Tenth Consecutive Month.

- Jobless Rate to Hold Steady at Annualized 5.6% for Third Month in July.

- Sign Up and Join DailyFX Market Analyst David Cottle LIVE to Cover the Australia Employment Report.

Trading the News: Australia Employment

Another 20.0K expansion in Australia Employment report may stoke a larger recovery in AUD/USD as it puts pressure on the Reserve Bank of Australia (RBA) to lift the cash rate from the record-low.

A positive development may push Governor Philip Lowe and Co. to adopt an improved outlook at the next meeting on September 5 as ‘various forward-looking indicators point to continued growth in employment over the period ahead.’ In turn, the shift in AUD/USD behavior may continue to unfold in the second-half of 2017 should the RBA gradually alter the monetary policy outlook over the coming months.

However, a dismal employment report may dampen the appeal of the Australian dollar as it encourages the RBA to carry the record-low cash rate into 2018.

Impact that Australia Employment report has had on AUD/USD during the previous print

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JUN 2017 | 07/20/2017 01:30:00 GMT | 15.0K | 14.0K | -18 | +2 |

June 2017 Australia Employment

AUD/USD 5-Minute Chart

DailyFX 3Q Forecasts Are Now Available

The Australian economy added another 14.0K jobs in June, while the Unemployment held steady at an annualized 5.6% for the second month even as the Participation Rate unexpectedly climbed to 65.0% from 64.9% in May. A deeper look at the report showed a 62.0K expansion in full-time employment, while part-time positions narrowed another 48.0K during the same period. Nevertheless, the initial market reaction was short-live, with AUD/USD pulling back from 0.7988 to end the day at 0.7955.

How To Trade This Event Risk(Video)

Bullish AUD Trade: Australia Adds Another 20.0K Jobs or More

- Need a green, five-minute candle following the report to favor a long AUD/USD position.

- If the market reaction favors a bullish aussie trade, buy AUD/USD with two separate lots.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish AUD Trade: Employment Report Fails to Meet Market Expectations

- Need a red, five-minute candle to favor a short aussie position.

- Implement the same setup as the bullish AUD trade, just in reverse.

Potential Price Targets For The Release

AUD/USD Daily Chart

Chart - Created Using Trading View

- AUD/USD may continue to retrace the decline from earlier this month as the pair clings to channel support and pushes to a fresh weekly high of 0.7925; the Relative Strength Index (RSI) appears to be highlighting a similar dynamic as it threatens the bearish formation carried over from the previous month.

- In turn, a move back above the 0.7930 (50% retracement) to 0.7940 (61.8% retracement) hurdle may open up the next region of interest around around 0.8020 (38.2% retracement) followed by the 2017-high at 0.8066.

- Interim Resistance: 0.8270 (38.2% retracement) to 0.8295 (2015-high)

- Interim Support: 0.7720 (23.6% retracement) to 0.7740 (78.6% expansion)

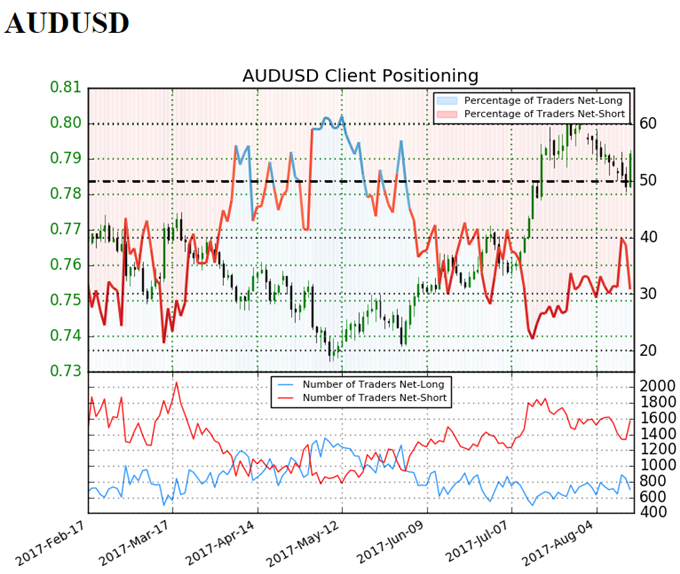

AUD/USD Retail Sentiment

Track Retail Sentiment with the New Gauge Developed by DailyFX Based on Trader Positioning

Retail trader data shows 30.8% of traders are net-long AUD/USD with the ratio of traders short to long at 2.24 to 1. In fact, traders have remained net-short since June 04 when AUD/USD traded near 0.74551; price has moved 6.2% higher since then. The number of traders net-long is 12.8% lower than yesterday and unchanged from last week, while the number of traders net-short is 16.0% higher than yesterday and 4.3% lower from last week.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.