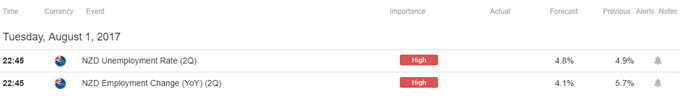

- New Zealand Employment to Slow for Third Consecutive Quarter.

- Jobless Rate to Narrow to Annualized 4.8%- Lowest Since 4Q 2008.

- NZD/USD Retail Net-Shorts Slip 14% from Previous Week.

Trading the News: New Zealand Employment Change

New Zealand’s 2Q Employment report may spark a bearish reaction in NZD/USD as the headline reading is expected to slow for the third consecutive quarter.

Why Is This Event Important:

A further slowdown in job growth may encourage the Reserve Bank of New Zealand (RBNZ) to retain the record-low cash rate beyond Governor Graeme Wheeler’s departure in September as officials warn ‘GDP growth in the March quarter was lower than expected.’ However, a downtick in the unemployment rate paired a marked expansion in Average Hourly Earnings may heighten the appeal of the New Zealand dollar as it puts pressure on the central bank to alter the outlook for monetary policy.

Impact that the New Zealand Employment report has had on NZD/USD during the last print

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

1Q 2017 | 05/02/2017 22:45:00 GMT | 5.3% | 5.7% | +24 | -60 |

1Q 2017 New Zealand Employment Change

NZD/USD 15-Minute

New Zealand Employment increased 5.7% per annum after expanding 5.8% during the last three-months of 2016, while the jobless rate narrowed to an annualized 4.9% during the same period to mark the lowest reading since 3Q 2016. A deeper look at the report showed Private Wages excluding Overtime held steady at 0.4%, while Average Hourly Earnings increased 0.3% during the first-quarter of 2017 amid forecasts for a 0.7% expansion. The initial market reaction was short-lived, with NZD/USD pulling back from a high of 0.6968 to end the day at 0.6878.

How To Trade This Event Risk(Video)

Bearish NZD Trade: Job Growth Slows, Household Earnings Remains Subdued

- Need a red five-minute candle following the fresh figures to consider a short NZD/USD position.

- If market reaction favors a bearish kiwi position, sell NZD/USD with two separate lots.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish NZD Trade: New Zealand Employment Report Exceeds Market Expectations

- Need a green, five-minute candle to consider a long NZD/USD position.

- Carry out the same setup as the bearish kiwi position, just in reverse.

Key Levels For NZD/USD

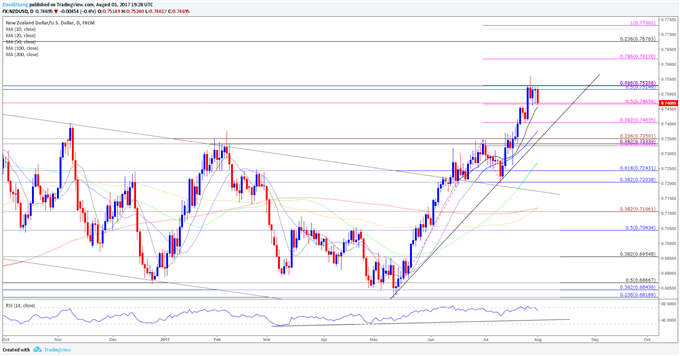

NZD/USD Daily Chart

DailyFX 3Q Forecasts Are Now Available

- The shift in NZD/USD behavior may continue to unfold in the second-half of the year as the pair clears the 2016-high (0.7485), but the near-term rally appears to be getting exhausted amid the string of failed attempt to close above the Fibonacci overlap around 0.7520 (50% expansion) 0.7530 (78.6% retracement).

- At the same time, the Relative Strength Index (RSI) appears to be coming off of overbought territory, with the oscillator at risk of moving back towards trendline support as the indicator fails to test the June-high (74).

- In turn, a close below 0.7470 (50% expansion) may encourage a move back towards the 0.7400 (38.2% expansion) handle, with the next downside hurdle coming in around the former-resistance zone around 0.7330 (38.2% retracement) to 0.7350 (23.6% expansion).

- Interim Resistance: 0.7730 (100% expansion) to 0.7744 (April 2015-high)

- Interim Support: 0.7330 (38.2% retracement) to 0.7350 (23.6% expansion)

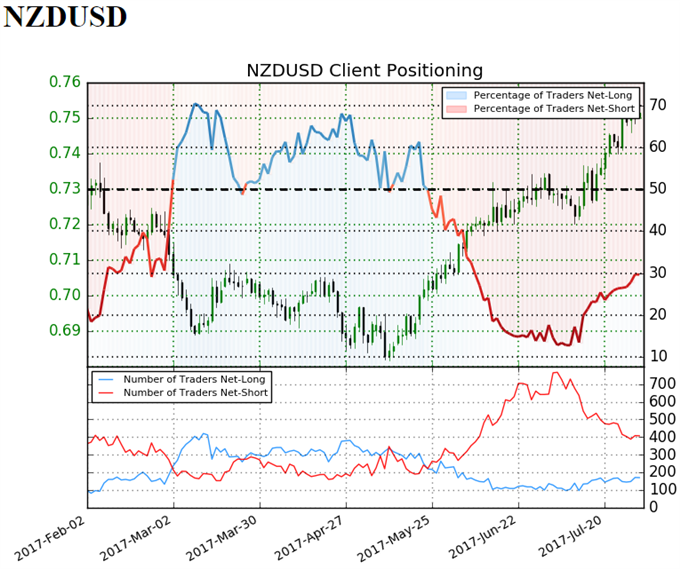

NZD/USD Retail Sentiment

Track Retail Sentiment with the New Gauge Developed by DailyFX Based on Trader Positioning

Retail trader data shows 29.7% of traders are net-long NZD/USD with the ratio of traders short to long at 2.37 to 1. In fact, traders have remained net-short since May 24 when NZD/USD traded near 0.68667; price has moved 8.8% higher since then. The number of traders net-long is 4.9% higher than yesterday and 2.8% lower from last week, while the number of traders net-short is 1.7% lower than yesterday and 13.6% lower from last week.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.