- Canada Consumer Price Index (CPI) to Slow for Second Month in June.

- Core Inflation to Hold Steady at Annualized 1.3% for Six Consecutive Months.

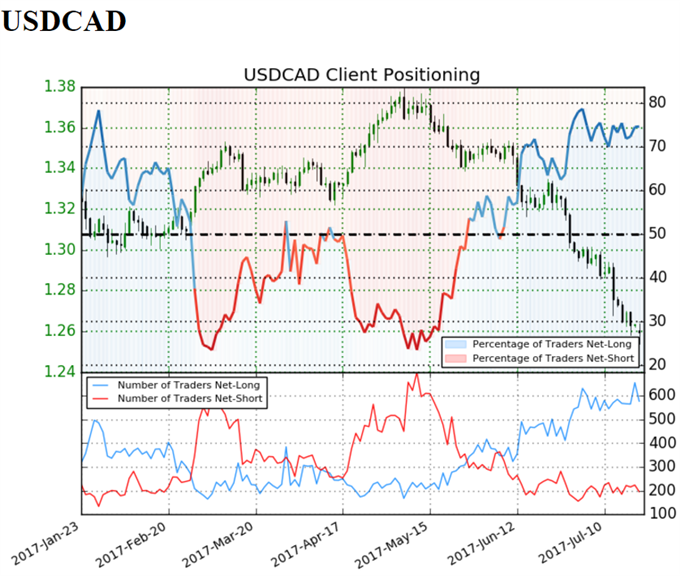

- Retail Crowd Remain Stubbornly Net-Long USD/CAD Since June 7, When It Traded Near 1.3481.

Trading the News: Canada Consumer Price Index (CPI)

Another slowdown in Canada’s Consumer Price Index (CPI) may tame the sharp depreciation in USD/CAD as it encourages the Bank of Canada (BoC) to adopt a more gradually path in normalizing monetary policy.

Why Is This Event Important:

Signs of softer-than-expected inflation may push the BoC to the sidelines as ‘very strong growth of the first quarter is expected to moderate over the balance of the year,’ and Governor Stephen Poloz and Co. may endorse a wait-and-see approach at the next meeting on September 6 as ‘geopolitical uncertainty still clouds the global outlook.’

Nevertheless, stickiness in the core rate of inflation accompanied by a further expansion in household consumption may encourage the BoC to adopt a more hawkish tone as ‘the output gap is now projected to close around the end of 2017, earlier than the Bank anticipated in its April Monetary Policy Report (MPR).’ In turn, BoC officials may continue to implement higher borrowing-costs over the coming months as the central bank expect to achieve the 2% target for price growth by the middle of 2018.

Impact that the CPI report has had on USD/CAD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

MAY 2017 | 06/23/2017 12:30:00 GMT | 1.5% | 1.3% | +83 | +52 |

May 2017 Canada Consumer Price Index (CPI)

USD/CAD 5-Minute

DailyFX 3Q Forecasts Are Now Available

Canada’s Consumer Price Index (CPI) slipped to an annualized 1.3% in May from 1.6% the month prior, while the core rate of inflation held steady at 1.3% per annum amid forecasts for a 1.4% print. A deeper look at the report showed the decline was largely led by lower energy prices, with transportation costs narrowing 0.7% in May, while prices for clothing and footwear bounced back 0.5% after contracting 1.1% in April. The Canadian dollar lost ground following the softer-than-expected inflation report, with USD/CAD turning around ahead of the 1.3200 handle to end the day at 1.3268.

How To Trade This Event Risk(Video)

Bearish CAD Trade: Canada Inflation Report Continues to Disappoint

- Need a green, five-minute candle following the report to consider a long USD/CAD position.

- If market reaction favors a bearish loonie trade, buy USD/CAD with two separate lots.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish CAD Trade: Headline & Core CPI Exceed Market Expectations

- Need a red, five-minute USD/CAD candle to consider a long loonie position.

- Implement the same setup as the bearish loonie trade, just in reverse.

Potential Price Targets For The Release

USD/CAD Daily

Chart - Created Using Trading View

- Downside targets remain on the radar as USD/CAD extends the series of lower-highs from earlier this week, while the Relative Strength Index (RSI) sits oversold territory for the first time since 2014.

- Break/close below the Fibonacci overlap around 1.2510 (78.6% retracement) to 1.2540 (78.6% expansion) opens up the next region of interest around 1.2420 (61.8% expansion) to 1.2440 (23.6% expansion).

- Keep in mind that USD/CAD will be at risk for a near-term correction once the RSI pushes above 30 and breaks the bearish formation carried over from May.

- Interim Resistance: 1.2940 (38.2% expansion) to 1.2980 61.8% retracement)

- Interim Support: 1.2420 (61.8% expansion) to 1.2440 (23.6% expansion)

Track Retail Sentiment in Real-Time with the New Gauge Developed by DailyFX

Retail trader data shows 74.6% of traders are net-long USD/CAD with the ratio of traders long to short at 2.94 to 1. In fact, traders have remained net-long since June 07 when USDCAD traded near 1.3481; price has moved 6.6% lower since then. The number of traders net-long is 12.7% lower than yesterday and 1.0% lower from last week, while the number of traders net-short is 17.3% lower than yesterday and 9.7% lower from last week.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.