- U.S. Consumer Confidence Survey to Narrow From Highest Reading Since 2001.

- 12-Month Inflation Expectations Have Softened for Last Two Consecutive Months.

Trading the News: U.S. Consumer Confidence

A downtick in the Conference Board’s U.S. Consumer Confidence survey may drag on the greenback as it casts a weakened outlook for growth and inflation, but the figure may do little to alter the monetary policy outlook as the Federal Reserve appears to be on course to implement additional rate-hikes over the coming months.

Why Is This Event Important:

The Federal Open Market Committee (FOMC) may continue to prepare U.S. households and businesses for higher borrowing-costs as the central bank closes in on its dual mandate, and Chair Janet Yellen and Co. may relay a more hawkish tone at the May 3 interest rate decision as ‘nearly all participants judged that the U.S. economy was operating at or near maximum employment.’ However, the FOMC may attempt to buy more time as ‘market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance,’ and the committee may try to tame market speculation as Fed Fund Futures price a greater than 60% probability for a June rate-hike.

Have a question about the currency markets? Join a Trading Q&A webinar and ask it live!

Expectations: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Average Hourly Earnings (YoY) (MAR) | 2.7% | 2.7% |

| Non-Farm Payrolls (MAR) | 180K | 98K |

| Personal Income (FEB) | 0.4% | 0.4% |

Easing job growth paired with subdued wages may weigh on household sentiment, and a marked downtick in the Conference Board’s survey may generate near-term headwinds for the U.S. dollar as it drags on interest-rate expectations.

Risk: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Existing Home Sales (MoM) (MAR) | -1.9% | 4.4% |

| Consumer Credit (FEB) | $15.000B | $15.206B |

| Gross Domestic Product (Annualized) (QoQ) (4Q F) | 2.0% | 2.1% |

Nevertheless, the pickup in private-sector lending accompanied by the ongoing expansion in the housing market may boost consumer confidence, and another positive development may trigger a bullish reaction in the greenback as it fuels bets for an imminent Fed rate-hike.

How To Trade This Event Risk(Video)

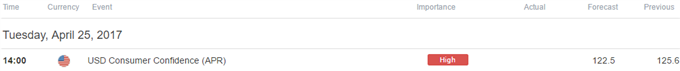

Bearish USD Trade: Consumer Confidence Index Narrows to 122.5 or Lower

- Need a green, five-minute candle following the report to consider a long EUR/USD position.

- If market reaction favors a bearish dollar trade, buy EUR/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: Conference Board Survey Continues to Beat Market Expectations

- Need a red, five-minute candle to favor a short EUR/USD trade.

- Implement same setup as the bearish dollar trade, just in the opposite direction.

Potential Price Targets For The Release

EUR/USD Daily

Chart - Created Using Trading View

- EUR/USD appears to be making a more meaningful attempt to break out of the downward trend carried over from 2016 following the first round of the French presidential election, but another failed attempt to hold above the Fibonacci overlap around 1.0880 (61.8% expansion) to 1.0910 (38.2% expansion) may generate a larger pullback ahead of the European Central Bank’s (ECB) April 27 policy meeting as President Mario Draghi and Co. keep the door open to further embark on its easing-cycle.

- Interim Resistance: 1.0880 (61.8% expansion) to 1.0910 (38.2% expansion)

- Interim Support: 1.0340 (2017-low) and 1.0370 (38.2% expansion)

Make Sure to Check Out the DailyFX Guides for Additional Trading Ideas!

Impact that the U.S. Consumer Confidence surveyhas had on EUR/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

MAR 2017 | 03/28/2017 14:00 GMT | 114.0 | 125.6 | -4 | -55 |

March 2017 U.S. Consumer Confidence

EUR/USD 5-Minute

The Conference Board’s U.S. Consumer Confidence survey unexpectedly climbed to a 16-year high in March, with the index advancing to 125.6 from a revised 116.1 in February. However, a deeper look at the report showed 12-month inflation expectations narrowed to 4.6% per annum from 4.8% per annum during the same period, and the Federal Open Market Committee (FOMC) may look to buy more time at the next interest rate decision on May 3 as the central bank warns ‘market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.’ Despite the limited market reaction, the greenback gained ground throughout the North American trade, with EUR/USD closing the day at 1.0813.

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.