- Bank of England (BoE) Widely Expected to Reestablish Easing-Cycle.

- Will BoE Governor Mark Carney Implement a Range of Policy Tools?

For more updates, sign up for David's e-mail distribution list.

Trading the News: Bank of England Interest Rate Decision

The Bank of England (BoE) interest rate decision may heavily impact the British Pound and spark a near-term decline in GBP/USD should the central bank revert back to its easing cycle and implement more non-standard measures to support the U.K. economy.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

With the U.K. preparing to depart from the European Union (EU), the BoE is widely anticipated to enlist a range of tools to insulate the real economy, but Governor Mark Carney may fail to deliver a multi-pronged approach to combat the risks surrounding ‘Brexit’ as the central bank sees a risk of overshooting the 2% inflation-target.

Expectations: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| GfK Consumer Confidence (JUL) | -8 | -12 |

| Retail Sales ex. Auto Fuel (MoM) (JUN) | -0.6% | -0.9% |

| Average Weekly Earnings ex. Bonus (3MoY) (MAY) | 2.4% | 2.2% |

Waning confidence paired with the slowdown in household spending may push the Monetary Policy Committee (MPC) to further support the real economy, and a wave of fresh monetary support may drag on the sterling as the central bank reestablishes its easing cycle.

Risk: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Net Consumer Credit (JUN) | 1.4B | 1.8B |

| Gross Domestic Product (YoY) (2Q A) | 2.1% | 2.2% |

| Consumer Price Index Core (YoY) (JUN) | 1.3% | 1.4% |

Nevertheless, sticky inflation accompanied by signs of a stronger-than-anticipated recovery may encourage the BoE to buy more time, and GBP/USD stands at risk for a relief rally should the central bank endorse a wait-and-see approach for monetary policy.

How To Trade This Event Risk(Video)

Bearish GBP Trade: BoE Implements Range of New Easing Measures

- Need red, five-minute candle following the rate decision to consider a short GBP/USD trade.

- If market reaction favors selling sterling, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: MPC Sticks with Status Quo

- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in the opposite direction.

Potential Price Targets For The Release

GBP/USD Daily

- Even though GBP/USD remains stuck within a wedge/triangle formation, the pair may stage a larger recovery as the Relative Strength Index (RSI) carves a bullish trend, with a break/close above 1.3370 (78.6% expansion) opening up the next topside target around 1.3640 (38.2% retracement).

- Key Resistance: 1.3870 (78.6% expansion) to 1.3900 (50% retracement)

- Key Support: 1.2460 (61.8% expansion) to 1.2500 pivot

Check out the short-term technical levels that matter for GBP/USD heading into the report!

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

Impact that the BoE Interest Rate Decision has had on GBP during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JUL 2016 | 07/14/2016 08:30 GMT | 0.50% | 0.50% | +157 | +99 |

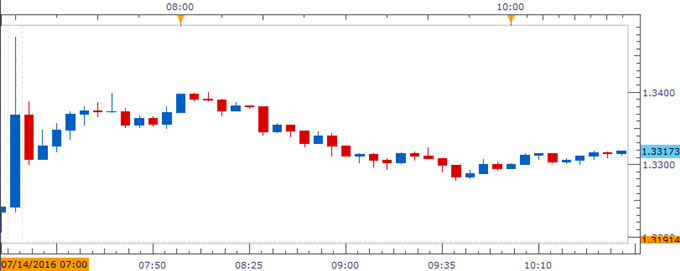

July 2016 Bank of England Interest Rate Decision

GBP/USD 5-Minute

The Bank of England (BoE) voted 8 to 1 to preserve the current policy in July, with Gertjan Vlieghe pushing for a 25bp rate-cut as the U.K. prepares to depart from the EU. Nevertheless, the central bank endorse a dovish outlook for monetary policy, with Governor Mark Carney and Co. pledging to take ‘whatever action is needed to support growth and to return inflation to the target over an appropriate horizon’ as ‘Brexit’ clouds the economic outlook for the U.K. The British Pound spiked higher as the BoE stuck to the sidelines, with GBP/USD coming off of the 1.3200 region to end the day at 1.3340.

Get our top trading opportunities of 2016 HERE

Read More:

S&P 500: Sharply Unchanged, Consolidating or Topping?

COT-British Pound Ownership Profile Warns of a Bottom

Post-Brexit NZDUSD Support Vulnerable to Weak NZ Trade Balance

USD/JPY July Recovery at Risk on Wait-and-See FOMC/BoJ Policy

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.